IP Tactics: What Deep Tech Startups Need to Know

This article explores four perspectives on how Deep Tech startups can leverage IP for their businesses, along with examples of particular situations including joint research, fundraising, and building business models.

Hello, I am Shohei Hirota, and I support portfolio companies in pursuing intellectual property (IP) activities at Global Brain (GB).

Few would doubt the notion that IP is crucial for Deep Tech startups. It seems obvious that obtaining patents is essential when dealing with cutting-edge technologies. However, some think that DeepTech startups do not necessarily need to rush to acquire patents if the technologies they possess are difficult to imitate.

As I mentioned in this post, startups without strong technological advantage can leverage patents to build moats, giving a greater impact of IP on their businesses.

On the other hand, for Deep Tech startups with extremely high technological advantages, the technologies themselves can be moats. For quantum computer- and space-related startups whose technologies are hard to imitate even without patents, reducing the priority of obtaining patents to invest in other resources instead may seem to make sense.

Now, to grow Deep Tech startups’ businesses, do we have other ways to use IP and patents besides moat building? This article will explore this topic by looking at four tactical perspectives.

1. Business sustainability perspective

First, there are two aspects that can cause business continuity issues down the line if Deep Tech startups are not aware of IP and patents.

Appropriate technology transfer

Many Deep Tech startups have spun out of universities and research institutions. A prerequisite for such startups to conduct business is whether they have properly transferred the rights for the research findings.

The following points will also be checked in legal and IP due diligence at the time of fundraising, a crucial process for startups.

-

Whether patent transfer and licensing agreement are appropriate

-

Whether risks and limitations in the agreement do not hamper future business expansion

Technology transfer will also be screened at the time of IPO. According to the guidelines for new listings on the Tokyo Stock Exchange Growth Market, startups spun out of universities must have necessary IP rights transferred to them, and if they have licenses, reasons must be given from multiple perspectives.

Accordingly, not taking IP measures may cause risks at the time of fundraising and IPO.

Freedom to Operate (FTO): Avoiding infringement of other companies’ patent rights

Another crucial point is the FTO, a perspective to check whether the business can be conducted without violating other companies’ patent rights in addition to just obtaining patents. If Deep Tech startups pursue IP activities with this FTO in mind, they will be able to avoid the risk of infringing rights and continue business.

When it comes to the Deep Tech sector, startups in some subsectors tend to apply for many patents as their higher technological level makes it relatively easier for them to be patented. For example, the semiconductor industry has many patents, with patent lawsuits and cross-licenses (licensing rights among companies) being actively carried out.

If unexpected patent rights infringement risks materialize at the time of mass production and product launch in the market, a company’s whole business plan could fall apart. While the FTO perspective is not an offensive but defensive IP activity, it is an essential factor that underpins business continuity.

2. Business strategy perspective

Next is about the situations where IP can be effective in startup business strategies.

Alliances: IP as a bargaining chip for alliance negotiations

For Deep Tech startups, alliances with companies and research institutions are crucial for many aspects including PoCs and joint research in the R&D phase and manufacturing cooperation in the mass production phase. In such situations, IP is important for those startups to reinforce negotiation capabilities and clarify how to handle achievements.

By successfully showcasing your IP when forming alliances with your partner companies, you can give them the incentive for partnering with you and elevate your negotiation capabilities.

In particular, the larger the potential partner corporations are, the more often they question why development is pursued in-house or whether there are other companies with better technology.

Even with such negotiation counterparts, if your startup possesses unique IP and patents, you could give them a clear incentive for the alliance by making them realize that they cannot advance this project without your startup.

Related to negotiation capabilities, one of the key points of PoC and joint R&D is the handling of development results.

When a startup initiates a project with a large corporation from scratch, it often creates a situation where the rights to the outcome are either split, or the large corporation claims ownership because they have borne the costs. This structure tends to put startups at a disadvantage.

If a startup already owns IP or patents (background IP) before entering into a joint project, it can focus negotiations on the results built upon that existing IP. Additionally, even if the startup has not contributed to the joint development costs, it can leverage the fact that its background IP is used. This makes it easier for them to assert their contribution and negotiate from a more favorable position.

Diversifying business models

Rather than simply undertaking contract development or operating a business model that handles everything in-house, startups can leverage IP for diverse business models. For example, hardware startups can utilize IP for fabless manufacturing, while pharmaceutical startups can license their IPs to pharmaceutical companies.

Here are two specific examples.

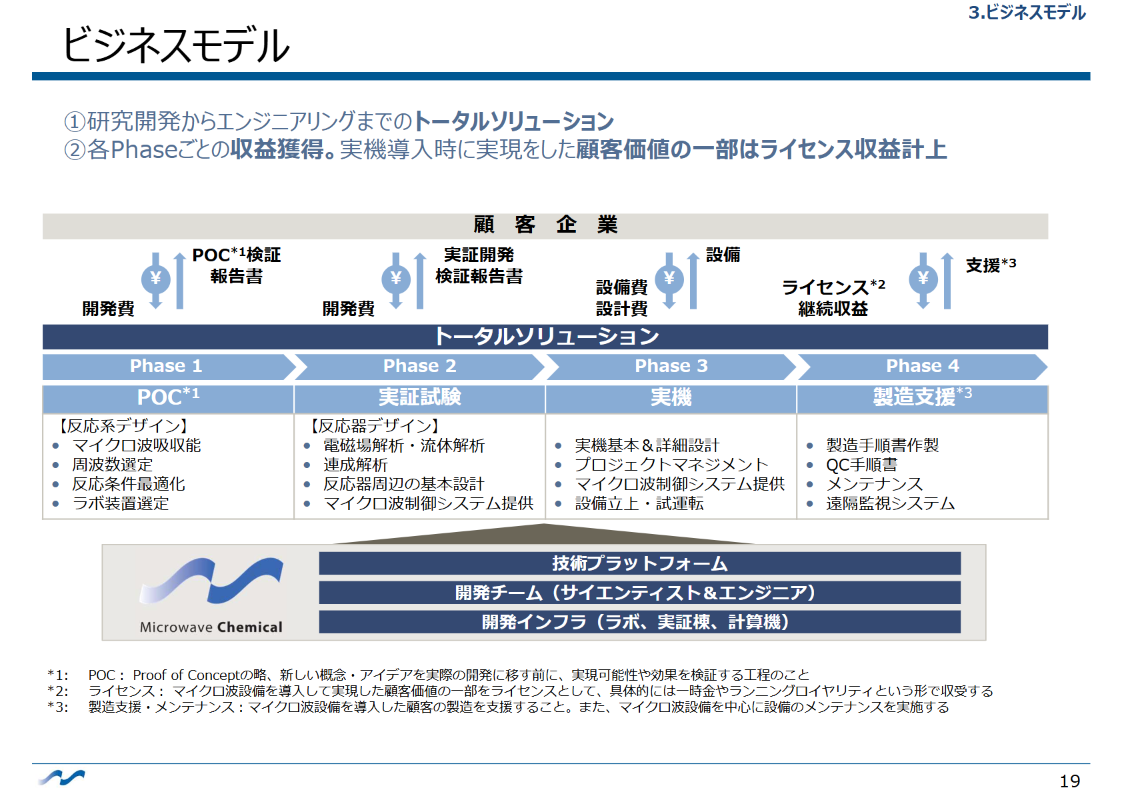

The first is Microwave Chemical, which utilizes microwaves used in microwave ovens to produce chemical products. Microwave Chemical provides solutions ranging from research and development to engineering for their customers, such as chemical manufacturers. Rather than selling products manufactured using microwaves, Microwave Chemical licenses technology packages necessary for customers’ operations, ensuring a steady stream of revenue.

The second is about a company called ExaWizard that develops AI-powered services. ExaWizard accumulates the algorithms and data obtained through projects with each of its AI platform business customers and uses them in its AI product business. It would have been impossible for ExaWizard to carry out such a business model without obtaining IP for the development achievements made through the projects with each customer.

In this way, Deep Tech startups can utilize IP and patents to create a more advantageous revenue structure, without being confined to a mere contract development business model. In other words, the startups can increase the options available for business strategies and business models through obtaining appropriate IP and patents.

3. Financial perspective

Fundraising appeal

In the Deep Tech sector, commercialization often takes considerable time, making it challenging to present quantitative achievements like sales figures during early-stage fundraising. In such instances, IP stands out as one of the few non-financial achievements that can appeal to investors.

To explain how far technological development has progressed toward commercialization and to what extent it results in technological advantage, IP and patents can be leveraged to showcase technological development outcomes and competitive advantages.

However, the number of patents a company holds does not directly relate to how much its corporate value increases. It is not as simple as that. What is crucial is to specifically explain how that IP and patents will contribute to future business growth and competitive advantage.

-

Technological uniqueness

-

Market differentiation

-

Possibility of future monetization (example: possibility of licensing revenue)

IP that can be explained in the above contexts will also be effective in financial aspects as reliable assets.

4. Organizational management perspective

Giving incentives to R&D specialists

IP can be used from the perspective of managing talented employees and securing competitiveness.

The most critical asset for Deep Tech startups is people or, in other words, highly skilled R&D specialists. Their technologies and know-how are the source of companies’ competitiveness.

Conversely, such technologies and information are strongly tied to individuals, carrying a risk of outflowing along with the talent.

So what the startups need to do is to properly accumulate IP internally by patenting technologies and ideas and visualizing/managing know-how as trade secrets. When the skills and know-how of talented personnel are retained within the startup, it becomes difficult for other companies to conduct similar R&D. As a result, it incentivizes the personnel to stay, allowing the startups to maintain competitive advantage.

Designing IP to leverage technologies for business

While IP is definitely one of the important management resources for Deep Tech startups, they may lose sight of the core essence if they blindly assume that IP is crucial just because they are Deep Tech startups.

IP does not have value on its own, but rather it demonstrates its true value when designed to be associated with the business. The first step to strategic IP activities is to think about the IP activities that are truly needed for your startup’s technology, business, and organization based on the four tactical perspectives introduced in this article. I hope this article provides some assistance to Deep Tech startups navigating their IP initiatives.

(Written by Shohei Hirota and edited by the Universe Editorial Team)

Shohei Hirota

Investment Group

Partner

Patent & Trademark Attorney

Shohei joined GB in 2020. He launched the IP team and is responsible for IP-related due diligence and support for portfolio startups. Shohei was registered as a patent attorney in 2013.