Why Japanese Companies Must Enter Africa

This article looks at “Africa today,” covering its latest economic situation and technological innovations.

Written by Hiroto Sorita and edited by the Universe editorial team

My name is Hiroto Sorita, and I mainly look after investment in African startups at Global Brain. Before joining Global Brain, I worked at the Africa Division of Toyota Tsusho Corporation, engaged in exporting automobiles for distributors and also led digital transformation projects using African startups’ products.

In the world of startup investment, the African market is attracting attention around the globe due to its high growth. However, people doing startup investment and business collaboration in Japan tend to see this region as “high-risk.” Many feel the hurdle is high to expand new business in Africa.

In this article, I will walk you through why Africa is at the center of attention and why now is the time for Japanese companies to enter the African market. By understanding the diplomatic context of major African countries and their accelerating relationships with Japan, Africa’s macro environment, and technological innovations, I hope you have a grasp of today’s Africa by the time you reach the end of this article.

Africa is taking a leap and going down in history

Among the developing nations known under the name “Global South,” Africa is leaving the others far behind with its growing potential and is in the spotlight on the global stage. What is interesting here is that Africa is showing its presence differently from how it used to in the past.

Africa has long been in the turmoil of continental conflicts. Even after it was freed from colonial rule, major powers such as the US, Europe, China, and Russia have impacted its economic situation.

However, today, African leaders are not succumbing to the great powers. Instead, they are drawing a line from them and aiming to maximize their own nation’s economic growth.

This is represented by the actions of President Tinubu of Nigeria, inaugurated in May 2023. For the G20 Leaders’ Summit held in India in the same year, he was the first head of state to arrive in India to consider joining the bloc of major world economies. President Tinubu did not receive support from other nations for his stay nor for traveling to and from India, proactively promoting the role Nigeria can play in solving global issues.

Although Nigeria was not admitted as a permanent member of the G20 bloc, proactive diplomatic policies by African leaders led to the G20 welcoming the African Union (AU) as a permanent member in September 2023. This showcased the African nations’ ambition to become an independent major power that stands on an equal footing with countries like the US and China.

Africa’s presence is also becoming stronger in Japan.

African development in Japan all started with The First Tokyo International Conference on African Development (TICAD) held in 1993. After entering the 21st century, the connection between the two has been strengthening more than ever.

TICAD IV held in 2008 announced its direction to “push forward African development through public-private partnership,” a major push for private companies to enter the African market. Furthermore, from the 2016 TICAD VI onwards, the cycle of the conference was shortened to be held every three years instead of five, opening up even more opportunities for discussions.

The most recent TICAD VIII was held in 2022 where Japanese Prime Minister Kishida announced “a total of USD 30 billion as the sum of public and private financial contributions to Africa over the next three years.” This was adopted as the Tunis Declaration. The declaration also stated its “focus on startups of energetic young Japanese and Africans,” clarifying that investment will go into startups.

At TICAD IX to be convened in Yokohama, Japan in 2025, the progress of the Tunis Declaration is expected to be discussed. We will likely see heightened expectations from Japanese companies toward African startups for business generation opportunities through investment and collaboration.

Understanding Africa from its macro environment

Let’s now look at the macro environment of Africa, where Japanese investment is planned. I would like you to grasp the big picture of Africa rather than looking at detailed numbers and data.

The five regions and colonial powers

We can of course look at Africa as a whole to discuss its economic environment, but here, let’s zoom in on each region’s situation.

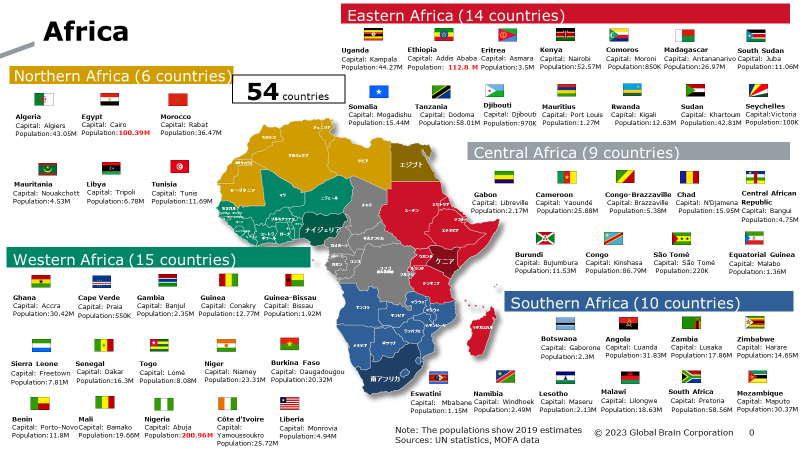

Africa is a continent with 54 countries. When we think of business in Africa, things look more clear if we divide it into five regions: “Northern,” “Eastern,” “Western,” “Southern,” and “Central.”

- Northern Africa consists of seven countries including Egypt, which has the biggest economy in the region.

- Eastern Africa consists of 14 countries including Kenya with the top number of Japanese companies, Ethiopia with a population of over 100 million, and Rwanda aiming to become the “Singapore of Africa.”

- Southern Africa consists of 10 countries including South Africa, which has long led the African economy.

- Western Africa consists of 15 countries including Nigeria, the only country in Africa with a population of over 200 million.

- Central Africa consists of nine countries, including Republic of Congo whose market has a large room for improvement but also has growth potential.

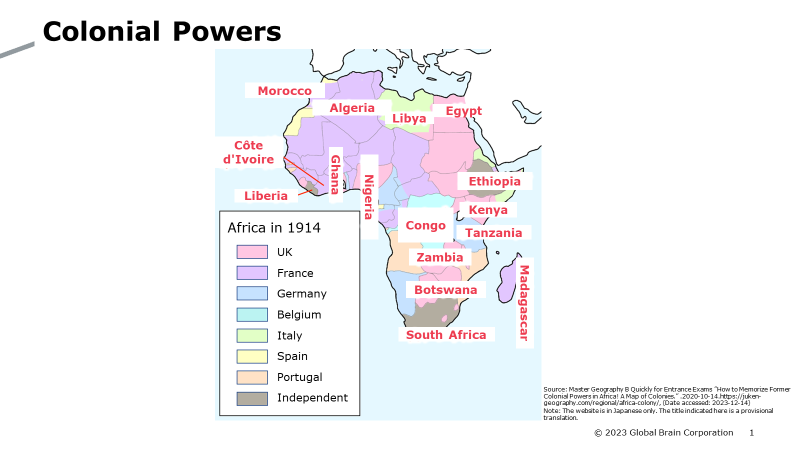

We should also understand the colonial powers that ruled Africa in the past. Different types of foreign companies have expanded in African countries, depending on which power ruled the country during colonial times. Understanding both the regions and the map of former colonial powers is key to considering investment strategies in Africa.

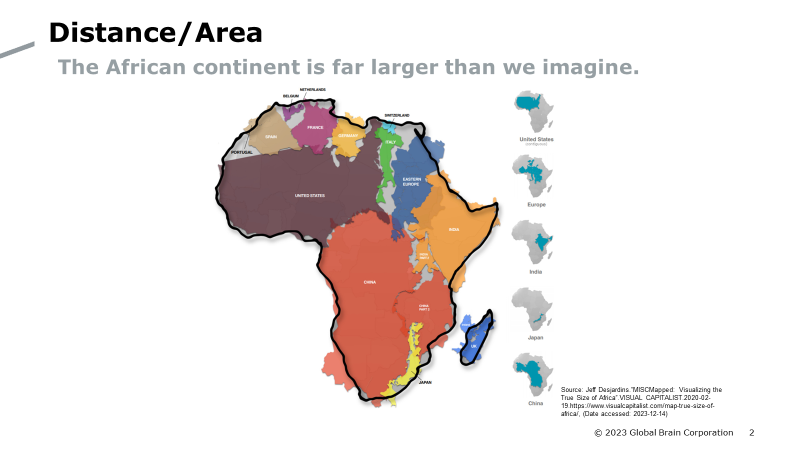

Vast land

The African continent is 20 times larger than Japan, much bigger in size than we imagine. The whole continent can encompass Japan, the US, China, India, and the EU combined. Its most eastern and western towns have completely different cultures and make us feel as if we were in different worlds.

Increasing population

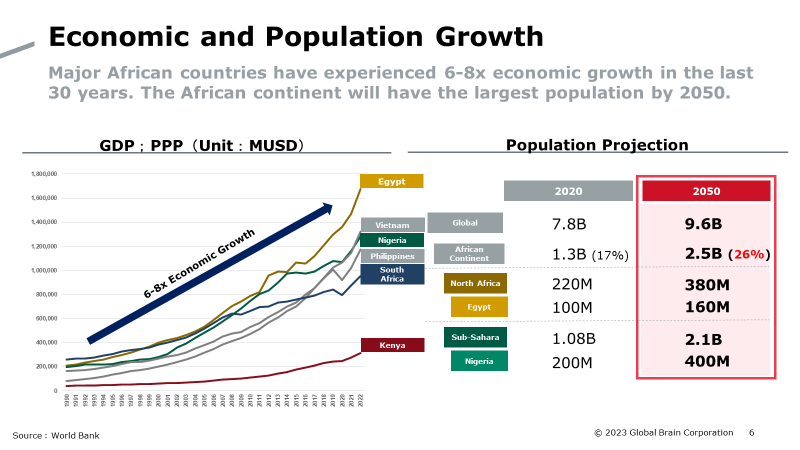

Africa has the biggest population in the world, with countries like Egypt and Nigeria where the population is over 100 million. It is forecasted that Congo and Ethiopia will also cross the 100 million line very soon.

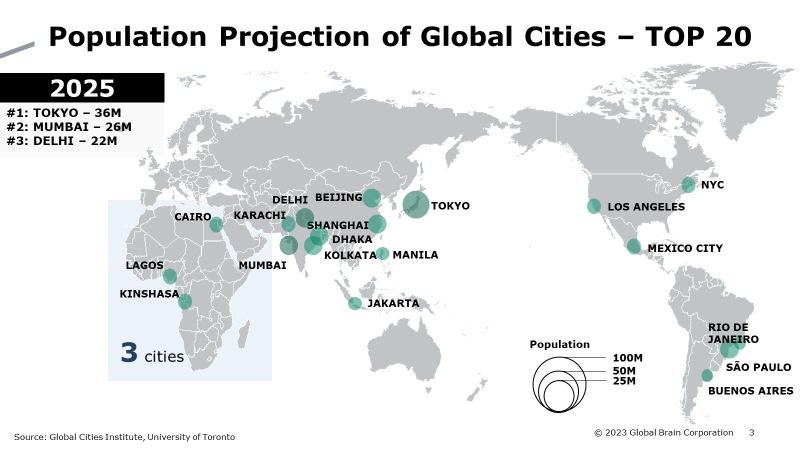

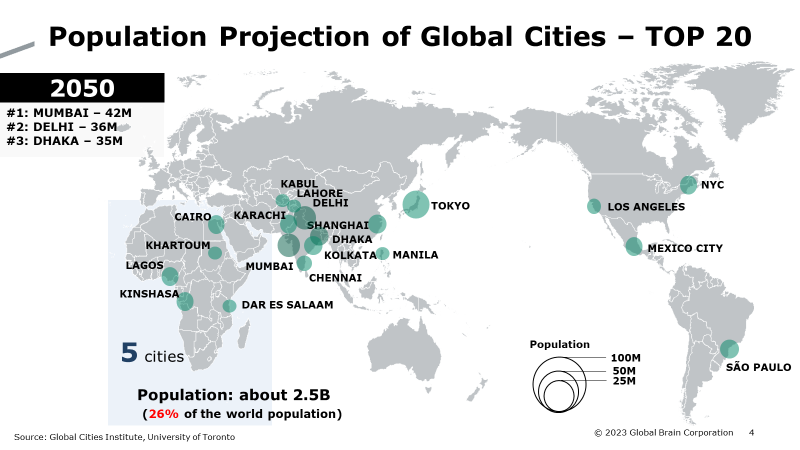

The images below show population outlooks in cities around the world for 2025 and 2050. By 2050, the population of five cities in Africa will account for 26% of the world population, meaning one in four people on the planet will be African.

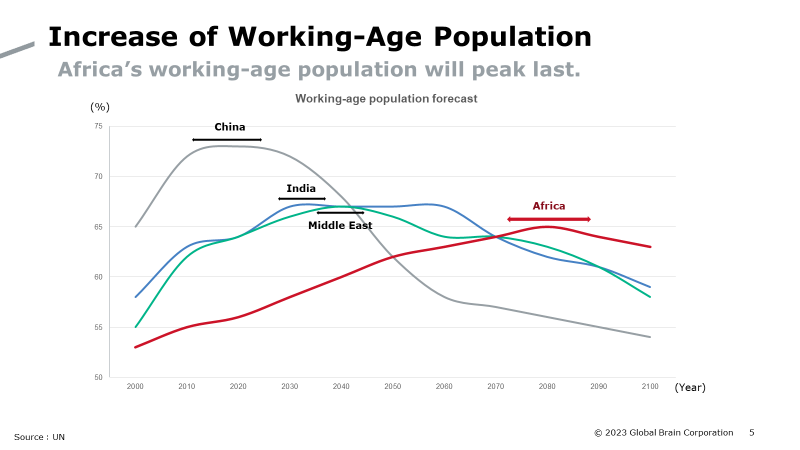

Africa’s working age population (ages 15 to 64) will peak in around 2080, later than other countries and regions. A long period of economic growth is expected.

Steady GDP growth

The GDP of major African countries such as Egypt and Nigeria have rocketed by 6 to 8 times in the past 30 years. This growth rate stands shoulder to shoulder with countries like Vietnam and the Philippines, showcasing Africa’s steady economic growth.

“Cellphones and the internet” - the most significant changes in Africa

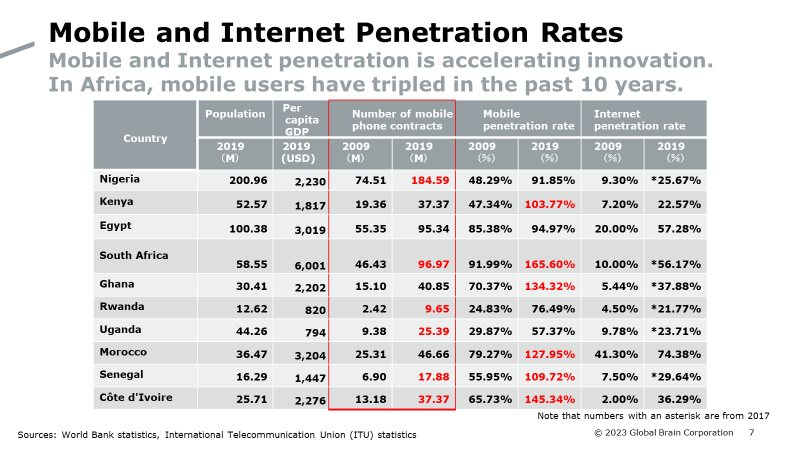

One noteworthy macro-economic change in Africa is technological “leapfrogging” - a rapid expansion of new technologies, greatly impacted by mobile and internet penetration rates.

In the past 10 years, the number of mobile phone users have tripled in the entire continent, with the penetration rate exceeding 100%. This means that one person has two to three mobile phones.

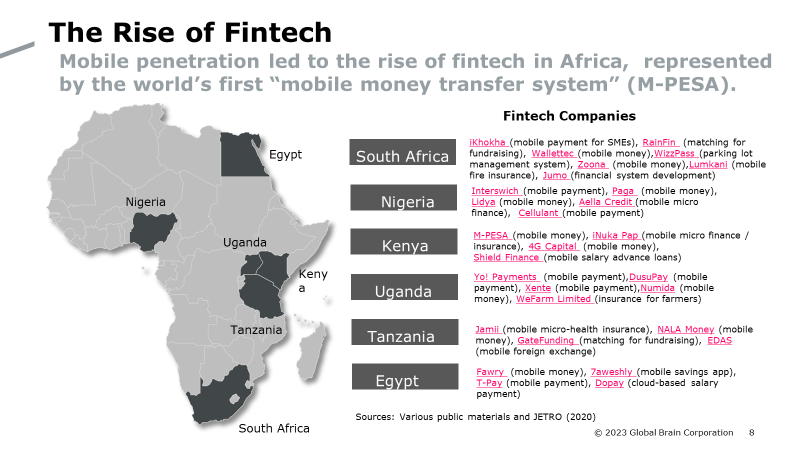

This was caused by the rapid expansion of mobile money transfer. Because many people in Africa could not open conventional bank accounts due lack of savings or credibility, mobile money transfer services that allow exchanges of money without the need for savings accounts saw an exponential growth. Kenya’s “M-PESA” is a good example.

Also, to separate money transfers for work or for home, it has become normal for one individual to own more than one mobile phone. The expansion of mobile phones has led to the emergence of various Fintech services, transforming Africa into a hotbed for Fintech.

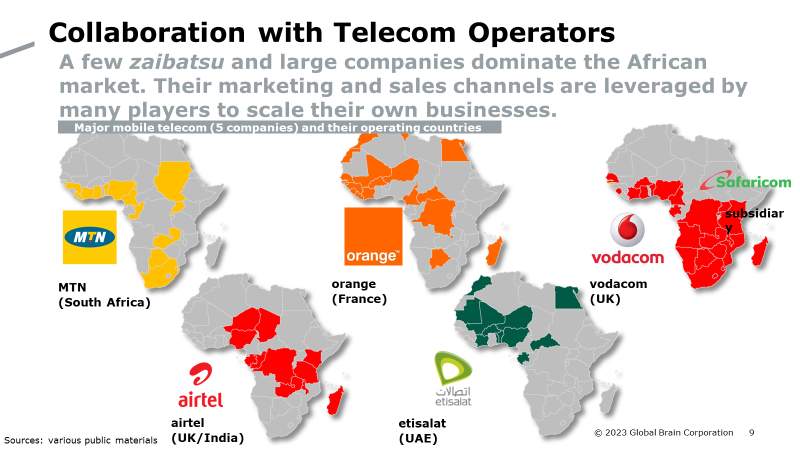

And it was the telecom operators who gained power with this trend. They have wide sales coverage and strong marketing power. When doing business in Africa, the key is to check which telecoms operator in which area you want to work with.

Closing

By observing Africa from multiple angles including diplomatic situations and the macro environment, if you feel a hint of potential for investment and business collaboration in Africa, that makes me happy.

More to come on startups rapidly growing in Africa and key points for Japanese companies to enter the African market. Please stay tuned.

(Follow our Global Brain Official X account to get updates on GB Universe articles.)

References:

- Japan External Trade Organization (JETRO) Middle East and Africa Division, Research Department. “The African Union (AU) gains permanent status in G-20”. 2023-09-15. https://www.jetro.go.jp/biznews/2023/09/8e0f4f9044916a5a.html (Date accessed: 2023-12-14)

- NDTV. “G20 Summit: Nigerian President Bola Tinubu Arrives In New Delhi”. NDTV.2023-09-05. https://www.ndtv.com/india-news/arrivals-begin-for-g20-summit-nigerian-president-bola-tinubu-arrives-in-new-delhi-4362793 (Date accessed: 2023-12-14)

- Ministry of Foreign Affairs of Japan. TICAD 30th Anniversary Event. “TICAD’s 30-Year History and Prospects” 2023-08-26. https://www.mofa.go.jp/af/af1/page1e_000748.html (Date accessed: 2023-12-14)

- Master Geography B Quickly for Entrance Exams ”How to Memorize Former Colonial Powers in Africa! A Map of Colonies.” 2020-10-14. https://juken-geography.com/regional/africa-colony/ (Date accessed: 2023-12-14)

- Jeff Desjardins. “MISCMapped: Visualizing the True Size of Africa”. VISUAL CAPITALIST. 2020-02-19. https://www.visualcapitalist.com/map-true-size-of-africa/ (Date accessed: 2023-12-14)

Please note that some of the articles listed here are in Japanese only and their titles are provisionary translations.

Hiroto Sorita

Global Brain Corporation

Investment Group

Director

Hiroto joined GB in 2021 and is responsible for sourcing, investment execution, and post-investment support for African startups mainly in Egypt, Kenya, Nigeria, and South Africa.