Supporting a Company Providing a Bed Bug Solution? Canon MJ's New Startup Investment Strategy

Canon Marketing Japan’s new CVC fund “Canon Marketing Japan MIRAI Fund” invests in startups that seem unrelated to Canon. We asked about their unique strategies, aims, and ambitions to create new businesses.

Written by the Universe Editorial Team

In June 2024, Canon Marketing Japan MIRAI Fund (Canon MJ MIRAI Fund), the CVC fund of Canon Marketing Japan Inc. (Canon MJ), invested in Valpas which offers a bed bug solution for hotels.

Canon is a company well-known for its cameras and multifunction printers. Then why did they invest in a startup that is seemingly irrelevant to their business? We sat down with Canon MJ MIRAI Fund’s members–Ryota Miyake, Manager of the Investment Group; Hinako Usui, an investment member responsible for Valpas; and Ryusei Abe, Manager of the Business Development Group to understand the aim, context, strategies, and unique strengths of the fund.

(The names of departments and roles may have changed after the interview.)

This “extraordinary” investment came along naturally

──Why did you invest in Valpas?

Abe: At Canon MJ, we aim to create new businesses under the theme of “achieving secure, safe, and sustainable travel and tourism.” We thought that Valpas could play a role here, and we also saw potential for synergy and business collaboration with Canon MJ’s group companies. We offer IT services to companies in various industries including manufacturing, logistics, and medical care, and we also support hotel businesses. Because Valpas offers a bed bug solution that is attached to beds and walls in hotel rooms, we imagined they could leverage Canon MJ Group’s channels such as Japanese hotels in order to expand their business. Bed bugs are a global problem. By working with Valpas, which offers a preventive solution, we have the possibility of expanding the entire value chain of our hotel support business.

Introductory video of Valpas’ solution

Usui: Our CVC fund aims to “invest in startups in and out of Japan, achieve worldwide co-creation, and create businesses that solve social issues”. Bed bugs are a threat to wellbeing in any country or region and incurs substantial damage especially in the travel and lodging industries. We believed it would be very meaningful to offer Valpas’ solution to the lodging industry customers as soon as possible, seeing how they were confronted with a bed bug crisis.

──Valpas is a Finnish startup. While some CVCs are reluctant to invest in foreign startups, how were you able to act so quickly?

Usui: Right after the CVC fund was launched, we actually did not have many ongoing discussions with foreign startups. However, Abe-san got on board bringing with him his experience in global investment and took the lead in meeting startups whether they might be Japanese or not. We were able to invest in Valpas because our team has members with diverse experiences and backgrounds like Abe-san.

Abe: For me, whether a startup is a foreign company or a Japanese company is not significant. I simply want to “do business with a good startup” and I think that is what connected me to Valpas, a company that aims to solve global issues.

Miyake: Our fund is open to both Japanese and foreign startups, and we invest in a wide range of areas. It goes without saying that we target areas like AI which are closely related to Canon’s existing business. In addition, we are already talking with startups in areas such as healthcare, regional revitalization, food, and culture.

Create businesses that solve social issues regardless of sector

──Why do you work with startups in various industries?

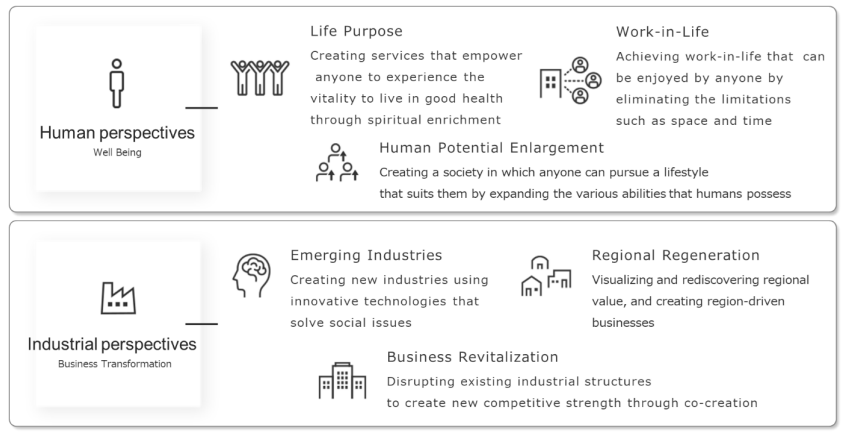

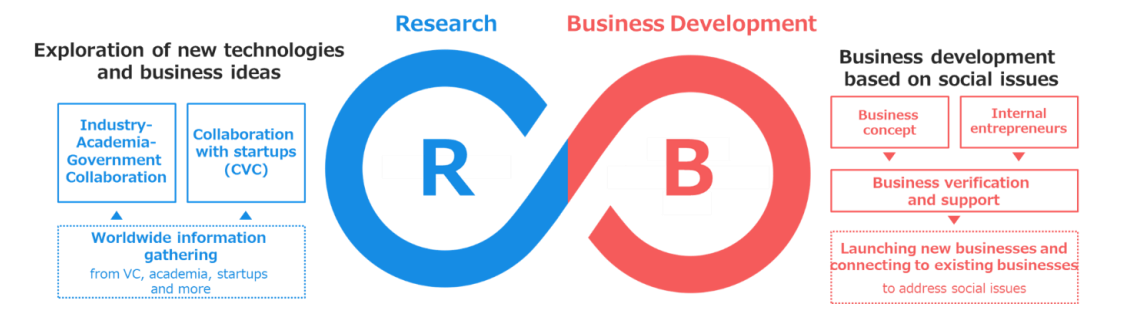

Miyake: Canon MJ MIRAI Fund is part of Canon MJ’s company-wide “R&B (Research & Business Development) initiative. R&B is a framework our company launched in January 2024 to continue creating businesses that solve social issues. We take various approaches such as public-private-academia partnerships and intrapreneurship projects.

While the commonly used term “R&D” is about creating products and services based on existing businesses and technology areas, we use the word “Business Development.” This is because we have the aspiration to embark on various co-creation projects in order to achieve our goal, which is to build a new industry without being confined to Canon’s existing business domains.

This idea is not new in itself and has been passed down in Canon MJ for many years. Despite being a domestic sales subsidiary of Canon, our company has a strong determination to “expand the business beyond Canon’s product areas”. We even had a slogan that went “Beyond CANON, Beyond JAPAN” 20 years ago. Our company is built on the mindset of expanding the business without being constrained to Canon products or Japan.

This ideology has been passed on to our R&B framework and the CVC fund both of which are technology/sector-agnostic and move toward creating various businesses that solve social issues. We aim to create businesses through co-creation with various external partners while of course placing importance on leveraging Canon MJ’s assets. This is what lies behind our collaboration with a company like Valpas which may come as a surprise considering their business domain.

──Why did you form a CVC fund instead of having Canon MJ’s business departments collaborate with startups on their own?

Miyake: Canon MJ has been proactive toward open innovation and has invested in startups directly or as an LP through VC firms. One significant success was when we created a solution through a capital and business alliance with Safie (in Japanese only).

We launched the R&B framework and the CVC fund to continuously bring about co-creation projects like the one with Safie for the long term, then scale those projects to create new business portfolios. To work systematically as a company to explore open innovation opportunities instead of having separate business departments act individually, we thought forming a CVC fund was the optimal way.

Having a long-term perspective is important when working with a startup. Especially if we are to invest in seed or early stage startups, we will need to work together with them for a long time in order to create the world we envision. We also need to consider making follow-on investments. That is why we formed a CVC fund of JPY 10B which is relatively large as a Japanese CVC.

We are not only mindful of our capital but also of resources. We always have one business development member and one investment member work together with each startup so that “investing does not become the final goal” of our CVC fund.

Abe: From my past experience working on CVC, I strongly acknowledge the importance of building long-term relationships with startups. Even if we end up not investing in a startup from our fund, we can connect them with other business divisions if there is potential for collaboration. I am eager to look for ways that can be beneficial for both sides in the long run.

“The power to grow together” is what supports startups

──You mentioned earlier that your CVC team not only has investment members but also business development members which is quite unique. What kind of experience do the business development members have?

Abe: I have experience working on new businesses and CVC related to the environment and energy areas. As for others, one member has experience in healthcare-related new business development and another has expertise in culture and entertainment.

Usui: As an investment member, it is very reassuring to have business development members who are experts in various different areas on the team. Whenever I come across a startup, I say to myself, “Abe-san will know about this area” or “XX-san seems like the right person to ask about this sector,” and I can go to them for help right away. Our investment members and business development members communicate actively to consider investments and collaborations.

Miyake: In addition to business development professionals, we also have on the team members who have worked for Canon MJ for a long time and therefore have strong internal networks. Some have experience in corporate functions. We are truly diverse. The management team led by President Adachi has a strong commitment to the R&B framework and CVC activities, and they thankfully assigned diverse members to our team.

──I can see that the entire company has a strong mindset to push forward collaboration with startups. Other than that power to move businesses forward, what are Canon MJ’s strengths and assets you can offer to startups?

Miyake: The largest asset we have is our marketing capability we have accumulated over the past 50 years. We have a wide range of sales channels, customer networks, and knowhow for both B2C and B2B businesses. Since Valpas was looking to expand its market in Japan, we thought Canon MJ Group’s customer network would be useful even as a short-term collaboration.

Usui: When I was working on consumer product sales in my previous department, I felt that the Japanese market has niche needs for after-sales services. Handling this carefully will result in improving brand recognition. Canon MJ Group’s knowhow in this area will surely be useful for startups aiming to expand sales in Japan. It is not just about selling a startup’s products using our B2B and B2C sales channels. I believe that we can grow together with the startups as business partners by staying connected with the customers through after-sales services.

Aiming for a breakthrough that can change the future

──I imagine you will continue to create businesses with various startups. Please tell us what kind of companies you are eager to work with and what kind of aspirations you wish them to have.

Usui: I am interested in working with startups that bring benefit to the seller, buyer, and society. When we look at Valpas, they offer a pesticide-free and chemical-free bed bug solution with little impact not only to humans but also to the ecosystem, reducing the burden on the environment. They aim to solve issues and achieve a sustainable world at the same time. This is the kind of startup I want to back up to create a good future together. I would be more than happy to grow together with startups that aim to bring about well-being in the broad sense.

Abe: I am also willing to meet startups that are determined to impact society and change the future. I want to use our assets for startups that have the passion and the technology to solve social issues. Canon MJ Group’s Purpose is “Bringing together hopes and ideas with technologies to create a future beyond imagining.” This is what we want to achieve through our business collaborations.

Miyake: When talking with startups, I always feel they have strong passions and hopes for their businesses. By bringing together their hopes and technologies with what we have cultivated, I would like to create numerous breakthroughs that can scale both our businesses. I look forward to meeting and working with many startups that resonate with our passion.