Startup and Government Relations: How michibiku Trailblazed into an Undeveloped Market

This article explores how michibiku, a Japanese startup that offers an eponymous platform that digitally transforms board meetings, worked with the hands-on support team at Global Brain to improve sales and promote government relations.

michibiku, Inc. (michibiku)’s platform enables digital transformation (DX) of board meetings by streamlining operational tasks as well as visualizing the content of such meetings. As it offers a new service that had never existed before, michibiku was facing unique challenges.

Thus, michibiku started to work on business improvements focused on sales in collaboration with the Value Up Team (VUT), a hands-on support team of the Japanese independent venture capital firm Global Brain (GB). They also started engaging in government relations (GR) activities to build relationships with the government and public administration, aiming to share their concerns with the Ministry of Economy, Trade and Industry (METI) and drive the transformation of board meetings across society.

We spoke with the members who undertook the business improvement efforts—Tatsunori Nakamura, CEO of michibiku, Kazumo Tachibana of VUT and Ko Kawaragi of the GR Support Team both at GB—about the strategies that startups should focus on when breaking into undeveloped markets with limited resources.

Challenges unique to launching a completely new service

──Could you tell us about the situation you were in when you started working with VUT and the challenges you were facing in your business division?

Nakamura: We started working with VUT around March 2024. At that time, there were two sales staff including myself, and the actual manpower was equivalent to 1.3 to 1.4 people.

We had two major challenges. One was that we lacked a scalable growth strategy that worked within our limited resources. We had a good number of sales negotiations, but the process for converting them into closed deals was not sufficiently verified. We were not sure how to improve the sales conversion rate after sales negotiations and whether we were even meeting with the right customers. It was more of a “just keep meeting and get as many deals as possible” sort of approach.

The second problem was pricing. While it is important to put in efforts to try to boost the number of deals and close rates constantly, it is unrealistic to achieve 100% . So, to scale the business, the unit price becomes a critical variable. However, we had not established a clear pricing strategy.

──What did you and VUT work on?

Tachibana: The first thing we worked on was to redefine michibiku’s target customers.

It is easier for us to focus on startups that are preparing for an IPO because they make decisions quickly to start using our service, but since their budgets are limited, we cannot raise prices, meaning we have to sell as many units as possible.

So, we held discussions taking into consideration the prospects for future business expansion and michibiku’s corporate vision, and clarified that we should focus on large companies listed on the Tokyo Stock Exchange Prime or Standard Markets as our target customers.

Introduction video of michibiku, the DX platform for board meetings(Japanese only)

After deciding on the target customers, we took specific actions such as improving the close rate. I also participated in business meetings with customers several times and visited michibiku’s office once a week to carry out improvement measures. I was holding meetings with one of michibiku’s executives or sales members all the time.

When it came to pricing, we struggled with the difficulties unique to michibiku’s platform. We could not figure out what the right price should be, even if we asked our customers since there was no product in the market that helps the digitalization of board meetings.

To find the right pricing, we introduced Nakamura-san to a CEO of a startup that offers a product which is similar to michibiku’s in that it targets people engaged in corporate management planning, and we set up a meeting.

Nakamura: There, I received advice that the unit price should be raised without hesitation.

As the founder, I was positive about raising the unit price of our product. However, the sales team who sells it would think, “How can we suddenly sell something that is currently priced at 10 for 20?” So I had to find a way to make the sales team feel confident about selling the product at the new price.

Hearing about the company’s case with Tachibana-san motivated the entire team to try it if others have been successful with it. It was a big step forward that we were able to overcome the limitations we had unconsciously imposed on ourselves by thinking we could only sell our products at a certain price.

Tachibana: In addition to calling for a price increase within the company, we also worked together to develop a method to actually sell the product at the revised price. For example, we included the number of times the new price was proposed in the KPI. Personally, I learned a lot from working together not only on the pricing strategy, but also on actions to ensure that this mindset was spread throughout the organization.

Overview of michibiku’s government relations (GR) activities

──What is the background behind the start of GR support?

Tachibana: Although we were able to raise the unit price, we needed to boost the close rate a little more in order to expand business. In addition to improving sales activities and products, we also wanted to create a trend in society.

Since michibiku’s product is the first of its kind, the emergence of a social trend that board meetings should also be digitalized will be a major tailwind. I had a feeling that things like corporate management, such as board meetings, tend to change when the policies or laws change, so around July last year, I asked Kawaragi, who provides GR support, for his help.

──What kind of support did you give, Kawaragi-san?

Kawaragi: First, I asked about the issues they wanted to solve in their business and their awareness of the problems in the industry. As we discussed, I felt that the corporate governance reform agenda which was originally proposed by METI seemed to fit with the direction michibiku wanted to take.

METI has been pursuing corporate governance reform for about 10 years now, and thanks to that, the structure of board meetings and outside directors in Japan has been standardized to some extent.

On the other hand, since there were concerns that this was not leading to corporate profitability, METI began holding study groups and creating guidelines last year to take the reform one step further.

So, Nakamura-san, Tachibana-san, and I visited METI to explain the commonalities between michibiku’s business and what METI was aiming to do. They were very interested, and we subsequently visited them four or five times to share michibiku’s insights.

──What did you actually discuss with METI? What did they request, and what information did you provide?

Kawaragi: METI had been conducting interviews and surveys with various companies to find specific cases of how companies were tackling board reform.

michibiku continuously offered them firsthand insights as the startup was familiar with issues related to board meetings and had multiple examples of solutions using its product.

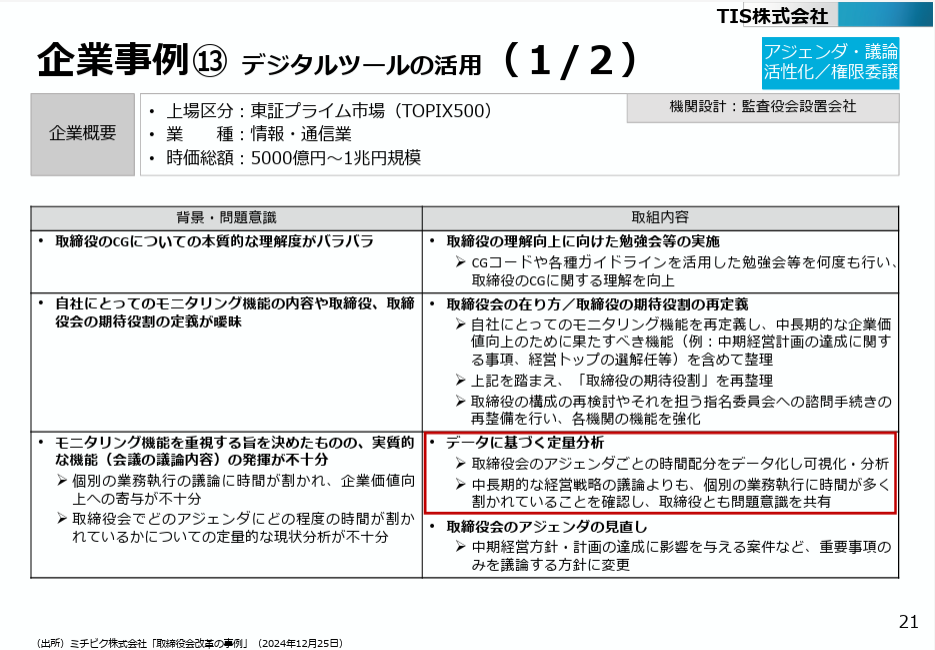

Nakamura: The METI’s study group includes academics and executives from major corporations, but they needed information from the field that they could not obtain on their own, so we shared examples and real-world issues that we were familiar with. They asked us questions like, “Are there any cases like this?” or “Do you have any information from this perspective?” and we replied to those questions as if they were homework assignments. We also asked TIS Inc. (TIS), which uses michibiku’s product, to join us at METI to share the real voices of their workers.

We consulted with Kawaragi-san many times, and he gave us detailed advice on everything from how to prepare materials to share with METI to the best timing for presenting them so that our concerns would be clearly conveyed.

Thanks to these efforts, the national guideline, published at the end of April this year, highlighted the message we wanted to emphasize in red and also mentioned our company name and case study with our customer, TIS. We could never have achieved this on our own, so we are very grateful.

It should not be just about your company making profits

──What are the effects and significance of GR activities?

Nakamura: My honest impression is, “Even a startup of our size can do it!” I did not know that METI was seeking such information, and I was surprised to find that they listened to our story so attentively.

It was remarkable that we were actually able to achieve an outcome like this. With the guidance publicly announced, we were given evidence that the government was objectively supporting this initiative, so our proposals to customers were no longer something that is for the sake and benefit of ourselves.

Not only can this evidence be used in sales, it can also be used for raising awareness for marketing purposes and also for recruiting personnel by conveying the message that this is the general trend today. The positive impact it has on our business is huge.

──What are the points to keep in mind in order to achieve results in GR activities like michibiku?

Kawaragi: When making proposals to the government or public agencies, it is important to not only focus on your company’s growth, but also to clearly outline how it will contribute to solving social issues in the future. Proposals that are perceived as being solely beneficial for a single company are often unsuccessful.

In michibiku’s case, I think they showed interest in us because we were able to make proposals that went beyond simply making the company profitable, such as how to effectively run and visualize board meetings, which would lead to solving issues within society at large.

In addition, an important point was that Nakamura-san fully committed himself to GR as CEO. I think METI took this very seriously, because the startup’s top management provided valuable input based on actual feedback from the field.

We were also lucky enough to communicate with the department that was working on the same challenges as michibiku in the quickest way possible. While corporate governance reform is also being implemented by the Financial Services Agency and the Tokyo Stock Exchange, we were able to quickly connect with the relevant department in METI which was trying to establish a study group. This is one of the factors that contributed to our success.

Nakamura: As Kawaragi-san said, it was vital that I prioritized GR activities and committed myself to them. I believe that I was able to gain trust by thoroughly and promptly responding to METI’s requests and paying attention to even the smallest details.

What startups should do when entering new markets

──Your initiatives with Tachibana and Kawaragi were aimed at helping startups in undeveloped markets achieve business growth. What perspectives are important when managing such startups?

Nakamura: The key is to deal with the right tasks that need to be prioritized. Previously, we had been allocating all of our resources to sales, but by prioritizing the initiative with Kawaragi-san and METI, we were able to engage in activities that will have a significant effect in the medium to long term.

However, when determining priorities, it is easy to overlook other possibilities if you are narrow-minded, so I think it is important to listen to the opinions of third parties such as Tachibana-san and Kawaragi-san when you proceed.

The rest is just determination and grit. Startups definitely need to be really active. It is impossible to do everything perfectly, and there were moments where we just had to power through it and get it done.

Tachibana: Indeed, we often discussed with Nakamura-san what he was best at and what he needed to spend the most time on and then prioritized tasks accordingly.

──What kind of support do you think VCs should provide to startups that offer first-of-its kind products?

Tachibana: I believe that our strength as a VC lies in our ability to view things from an objective perspective, taking into account both the short term and the medium to long term.

Startups need to do things that will have an immediate impact, but they also need to do things with an eye toward the medium to long term. For example, helping to increase the number of business negotiations or orders may be effective in the short term, but whether or not the foundation for long-term success has been laid is a different issue that needs to be considered separately.

It is not easy to provide GR and intellectual property support which has a medium- to long-term impact and sales support unless you have nearly 40 members (as of May 2025) in the hands-on support team like GB.

I believe that one of our strengths is our ability to shift between short-term and medium- to long-term perspectives while discussing priorities and identifying issues.

Kawaragi: When creating a market for a product that does not yet exist, there are many situations where it is necessary to involve players with social influence. These may be well-known large corporations or national/public institutions. GB’s network has built extensive relationships with both types of entities, and we believe that this is one of the values we can offer.

The GR team often supports portfolio startups with regulatory reform and helps them take advantage of government support measures. The case with michibiku was a new initiative in which we worked with the government to create guidelines and seek business support through policy measures. Building up this kind of experience will enable GB to offer a wider range of support, so it was quite invaluable for us too.

Nakamura: GB’s support is very hands-on, not just words. For example, Tachibana-san would say, “Let’s extract the sales data from Salesforce and analyze it,” while Kawaragi-san would suggest, “I got hold of METI’s schedule for the study groups, so let’s work backwards and take this approach.” That was really helpful for us.

──Now that the government guidelines have been released and the wind is starting to blow in your favor, could you share your thoughts on michibiku’s business outlook?

Nakamura: Firstly, we want to make michibiku the infrastructure for the DX of board meetings. To achieve this, we intend to effectively utilize the corporate governance guidance as a tool for creating contact points with our customers.

Our next vision is to combine michibiku with AI. Data on Japanese corporate board meetings had not been structured, but we have been accumulating a large amount of data from board meetings, including audio and minutes. We are probably the only company in Japan that has this level of board data.

By feeding AI with securities reports, IR materials, external environmental data, and other information, and simply asking it, “What should be discussed at the board of directors meeting?,” it can provide a reasonable answer. Some companies may already be doing this. In addition, you can obtain more insightful answers

If this develops, we should be able to provide services similar to those offered by major foreign consulting firms, which currently only a few percent of companies have access to.

Of course, it may be difficult to achieve their level of expertise right away, but we believe that strategic consulting will eventually become more accessible, enabling DX in management decision-making. We will aim to expand our business with this goal in mind.

Note: The names of roles and affiliations may have changed after the interview.

(Interviewed and written by the Universe Editorial Team)

Due to the highly confidential nature of the data, technical verification is being conducted with the consent of the customers and under the most stringent security measures. ↩︎