Selecting the Target Market: shizai's New Business and Its Takeaways

shizai is a marketplace startup which offers custom packaging materials. We asked what challenges it faced and how it overcame the obstacles in launching its new business, shizai pro, a procurement management tool targeting e-commerce and D2C companies.

Written by the Universe Editorial Team

shizai, Inc. (shizai) is a startup which offers a marketplace where companies in industries such as apparel, food, and cosmetics can order custom packaging materials.

In an attempt to further expand its business, shizai embarked on launching a new SaaS product named shizai pro which streamlines customers’ procurement operations from top to bottom. After conducting PoCs with partnering businesses, shizai pro was officially launched in 2025. The business is off to a good start - a retailer with stores all over Japan and multiple prominent D2C companies have already implemented the product.

However, shizai initially had zero experience in SaaS businesses and therefore had to formulate its strategy from scratch. How did shizai launch a new business while maintaining its existing marketplace’s growth? We sat down with Nobuyuki Suzuki, CEO of shizai, and Naoki Sato, a Value Up Team (VUT) member of Global Brain who helped devise the strategy.

(The names of departments and roles may have changed after the interview.)

Challenges with the first SaaS business

──What is the story behind shizai pro?

Suzuki: We launched the company in 2020 as a startup that offers a marketplace named shizai, where we sell packaging materials to e-commerce and D2C businesses. To be honest, we had the shizai pro idea in our minds from the beginning. To differentiate ourselves as a tech company in a long-standing industry of materials and printing, the key was, as we understood, to leverage software before and after procurement processes.

As we were supporting our customers’ operations to test this hypothesis, our customers started saying that they wanted to centrally manage the entire procurement process including products and promotional items, not only packaging materials. That was what made us shift the development of shizai pro into high gear to streamline order processing operations. When we were offering the β version of the product, multiple customers expressed interest in paying to use an official version, so we decided to formulate strategies aiming for an official launch.

──What brought VUT into the strategy formulation process?

Sato: VUT had been supporting shizai since before to enhance the B2B sales structure for its existing marketplace business and to strengthen the foundation of its business through company-wide implementation of KPI management. After we had achieved those initiatives to a certain extent, we started discussing what needs to be done for shizai to move on to its next step of growth and decided to focus on formulating the strategy for shizai pro.

Suzuki: I had no experience launching or growing SaaS businesses and therefore had no clear idea on how I should build a business strategy. Although I knew general PMF indicators for SaaS products, leveraging that knowledge to build strategies was a completely different story.

Also, because I am overseeing our existing business, I could not commit myself sufficiently to the development of a strategy for the new business. That was when the VUT, who had given great impact to our company in their previous support efforts, proposed to help us put together a strategy for shizai pro to take us to the next level. We were more than happy to accept their offer.

Two phases to define target markets

──Can you share in detail what steps you followed to work out your strategies?

Sato: We roughly had two phases. In phase one, we conducted trial interviews with existing customers of shizai.

From these customers that shizai already had relationships with, we learned what part of the materials and promotional items procurement process they were facing challenges with. Suzuki-san himself went out to speak with various customers ranging from large enterprise customers to SMBs across many industries such as food, apparel, and cosmetics, totaling to 30 companies in about two months.

I joined these customer meetings with him and felt that we had deep conversations, given they were all customers shizai had built relationships with through its existing business. This is actually a merit you get when you are building a new business in addition to an existing one.

Suzuki: In phase one, I was mindful of listening to the customers’ voices without any preconceptions and without hypothesizing the customers’ problems too much. As a result, we learned that customers were facing problems we had never imagined. Resending facsimiles every time the procurement information is updated posed time-efficiency challenges for some customers, and others found it important to integrate with production and product management systems which is a must given the strong connection between materials staff and production management / product development divisions.

Sato: By deep-diving with each customer and gathering various opinions, we moved on to phase two, the strategy formulation phase.

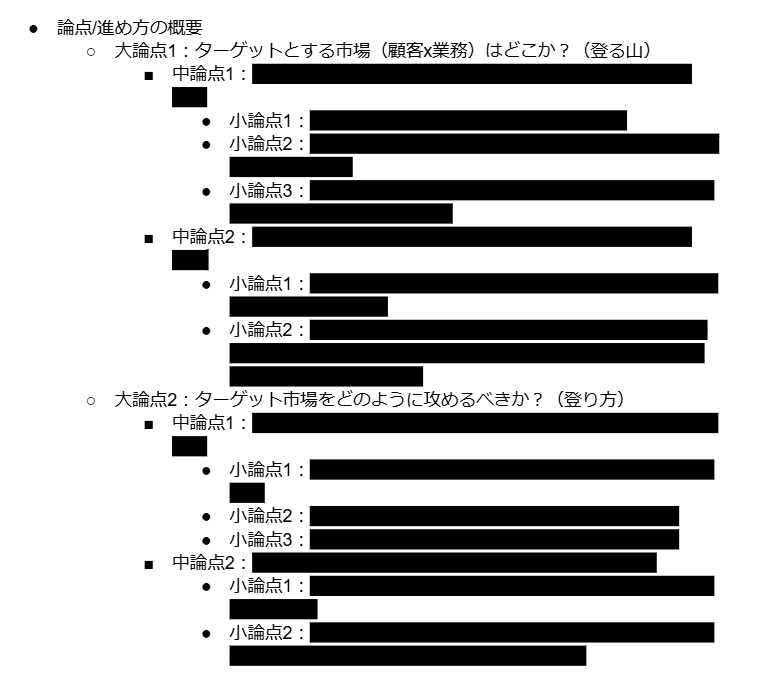

Since we needed to verify every minor discussion point to put together a strategy, we used various frameworks to brainstorm the discussion points.

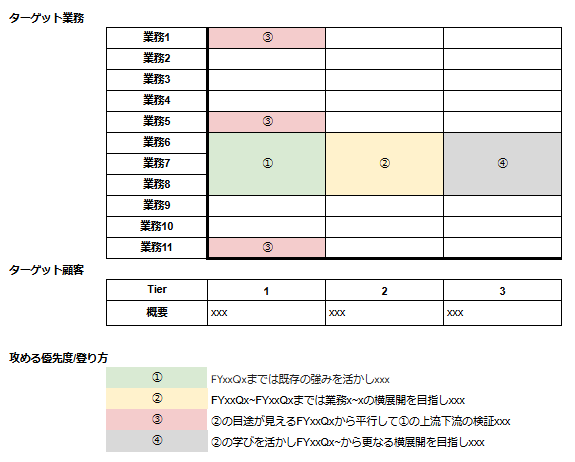

For example, by placing customers’ industries on the vertical axis and work processes on the horizontal axis, we sorted out what markets exist around shizai pro then discussed which market we should target first, and how based on our discussion points and evaluation standards.

──I understand. As for which market to target and how to do so, how did you decide?

Sato: We took a vertically and horizontally segmented market and evaluated it from the following three perspectives to fix priorities: 1) Customers, 2) Our company, and 3) Competitors.

-

- Customers: The seriousness of customers’ problems, the distinctiveness/universality of a problem, and the number of customer companies

-

- Our company: Affinity with the assets of our existing marketplace business

-

- Competitors: The competitive landscape

From these three points, we identified the market where shizai pro’s value will shine out the most and defined it as Tier 1. We also discussed how to design the product to approach that specific market and brainstormed from various angles. Do we need to enhance the β version’s functions? Should we add new functions? Do we need to customize the product looking ahead to Tier 2 customers?

Suzuki: We took the learnings we gained by deep-diving into each customer and incorporated them into our framework to conceptualize the takeaways, which allowed us to map out a more precise strategy. By carefully repeating the process of identifying exactly where in our framework the comments we received from each customer fit into, we gradually refined our strategy.

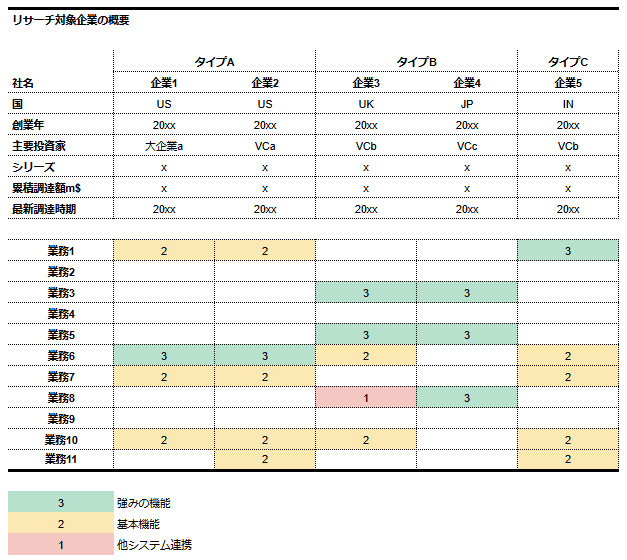

Sato: Upon designing detailed functions and UI based on the strategy, we not only referred to similar services in Japan but also products in countries like the US, the UK, and India. We did not merely look up information, but instead, Suzuki-san and the product team members checked product demos and UIs to brainstorm how they could be implemented on shizai pro and the feasibility. After selecting specific functions we thought shizai pro customers would see value in, we held customer interviews to explore and identify the optimal way of implementation.

──What was the most significant advantage of formulating very detailed strategies?

Suzuki: We succeeded in identifying the target market, which on the flip side, means we were able to find out customer segments and problems we do not need to target now. This was a huge accomplishment.

Industries with many potential customers can seem very attractive for B2B startups, but in the early stages, they should narrow the target markets and target operations. While this may sound like common sense, it is actually a very difficult decision to make. You will hear internal and external stakeholders questioning your decision, saying, “Why not start with a bigger market?” Without a clear logic to underpin your decision, you may find yourself dithering.

Being able to explicitly say, “We have already looked into that point, and as a result, decided we do not need to target the market due to this reason” helped reduce the cost of management decision-making greatly.

Of course, this does not imply that we will be forever excluding other industries and operations from our target. Just the fact that we were able to say “not now” for the coming one to two years improved the quality of management decisions greatly. I can sleep like a baby now (laughs).

Identifying where not to target before deciding where to focus our limited resources on was as important as deciding where to target.

How to overcome challenges unique to a new business

──I have the impression your strategy formulation went very smoothly. Did you face any difficulties?

Suzuki: It was actually not that easy because launching a new business while running an existing one was a challenge in itself.

The processes for driving an existing business and a new one are completely different. The problem we have to solve with the former is to find out how we can prop up performance. We have to work through various could-be factors such as conversion rate, resource allocation, or sales structures.

On the contrary, a new business has no track record for us to improve. All we can do is to expand our thoughts by inferring from very little information, doing guesswork, and banking on the CEO’s intention.

To be honest, going back and forth between working to improve an existing business and wracking my brain to come up with a new business was very exhausting. You have to switch your brain in entirely different ways.

In that sense, I feel like Sato-san took some of the burden off my brain. Of course I asked my team to pull together strategies and measures, but we only have so much resources. I am very grateful to Sato-san for being my discussion partner for the new business.

Sato: The marketplace business shizai already has was once a new business too, so Suzuki-san is of course perfectly capable of launching a new business. However, as he just mentioned, I can understand it must have been challenging to stay fully committed to improving the existing business and start building the logic for a new business at the same time.

Suzuki: The initial TAM we had in mind for shizai pro was actually very small, one reason being I tend to be hard-headed, but also because I had not been able to broaden my view given my brain was overloaded from concentrating on the new business while running the existing business.

That was when Sato-san showed me how I can look at the TAM in a completely different way and changed my views drastically. This was another positive outcome getting help from the VUT who is an outsider.

Takeaways that will contribute to future initiatives

──Lastly, tell us what you learned from the process of formulating strategies.

Sato: The VUT had two major takeaways. One is the knowhow of supporting startups nearing Series B funding. We mainly invest in Series A startups from our flagship funds, and our mission is to help the growth of those companies’ existing businesses. But shizai was rather closer to Series B, struggling to launch a new business. Our experience working with shizai can be leveraged when assisting other portfolio companies in similar phases.

The second is we were able to experience working with a compound startup or in other words a multi-product startup, both concepts garnering attention recently. These namings refer to startups that launch multiple products and leverage shared resources to achieve bigger outcomes with less effort, instead of selling a single product to existing customers. shizai pro’s case is a typical example. Considering upcoming industry trends, I am positive our learnings from shizai will be useful.

Suzuki: I also had two takeaways. The first is what I mentioned earlier about how the way you work is completely different with an existing business and a new one. I became keenly aware of the need to separate my mindset for the two types of businesses. This time I had Sato-san as my partner to deep-dive into designing the new business, but going forward I am eager to structure my organization to make it ready to take on new challenges.

The second is that when you are getting down to work with a new business, the sooner the better. When the first initiative with VUT ended, they said to us, “So next comes the shizai pro product. We appreciate you have already developed a product that functions.”

If you wait until your existing business gets on track and starts performing to build your new business from scratch, you will have a very late start, having to take time going through multiple steps such as meeting the users, building an MVP, testing, and so on.

But as for shizai pro, since we had already completed the hypothesis and verification phases and had built the initial version of the product, that allowed us to go into high gear right after confirming our existing business was in a good place. This was a very big advantage.

This may sound obvious, but if you are planning to run multiple products or businesses all at once, the ironclad rule is to start as soon as you can. My message to startups seeking a new business is to try acting early as possible, and I would say the same thing to my future self.