GB ESG Survey 2024: 103 Startups’ Current Positions and Issues

Global Brain conducted an “ESG survey” to find out where our portfolio startups’ ESG practices stand now. This article reports on its results, including the overview and issues of startups’ ESG implementation and their initiatives.

Written by Nagisa Shigetomi and Kenji Hayashi, edited by the Universe Editorial Team

Survey on startups’ ESG practices

In recent years, “ESG” has become vital for companies’ long-term business activities. The concept is further spreading in Japan, and even startups are beginning to pay attention to it.

To support our portfolio startups in pursuing ESG management, Global Brain (GB) set out an ESG policy in 2021. In line with the policy, GB conducted an “ESG survey” to find out where our portfolio startups’ ESG practices stand now. This article reports on its results, including the overview and issues of startups’ ESG implementation and their initiatives. We hope that the survey results will lead to further ESG awareness among startups.

About the survey

Overview

- Method: Google forms

- Number of questions: 45

- Duration: Friday, March 29, 2024 through Wednesday, April 17, 2024

- Target: All GB portfolio companies in Japan and overseas (Mandatory for GB8 fund portfolio companies in which GB invested as the lead investor, optional for other portfolio companies)

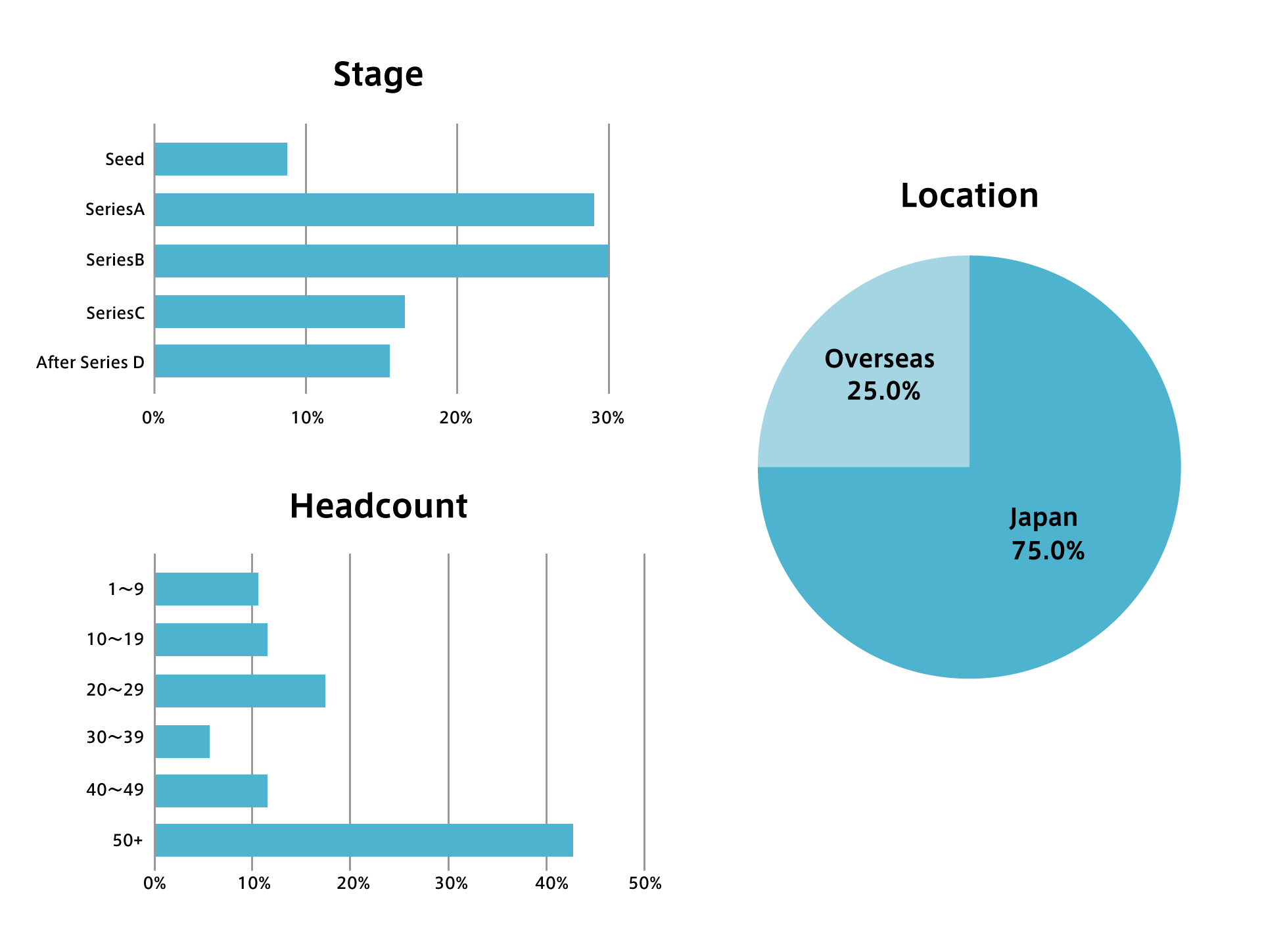

- Number of companies that completed the survey before the deadline: 103 (Japan: 80, overseas: 23)

- 75% of the startups that completed the survey are located in Japan, and more than 50% are in Series B or later stages with 40 employees or more.

Environment

Environmentally-friendly initiatives were conducted regardless of stage

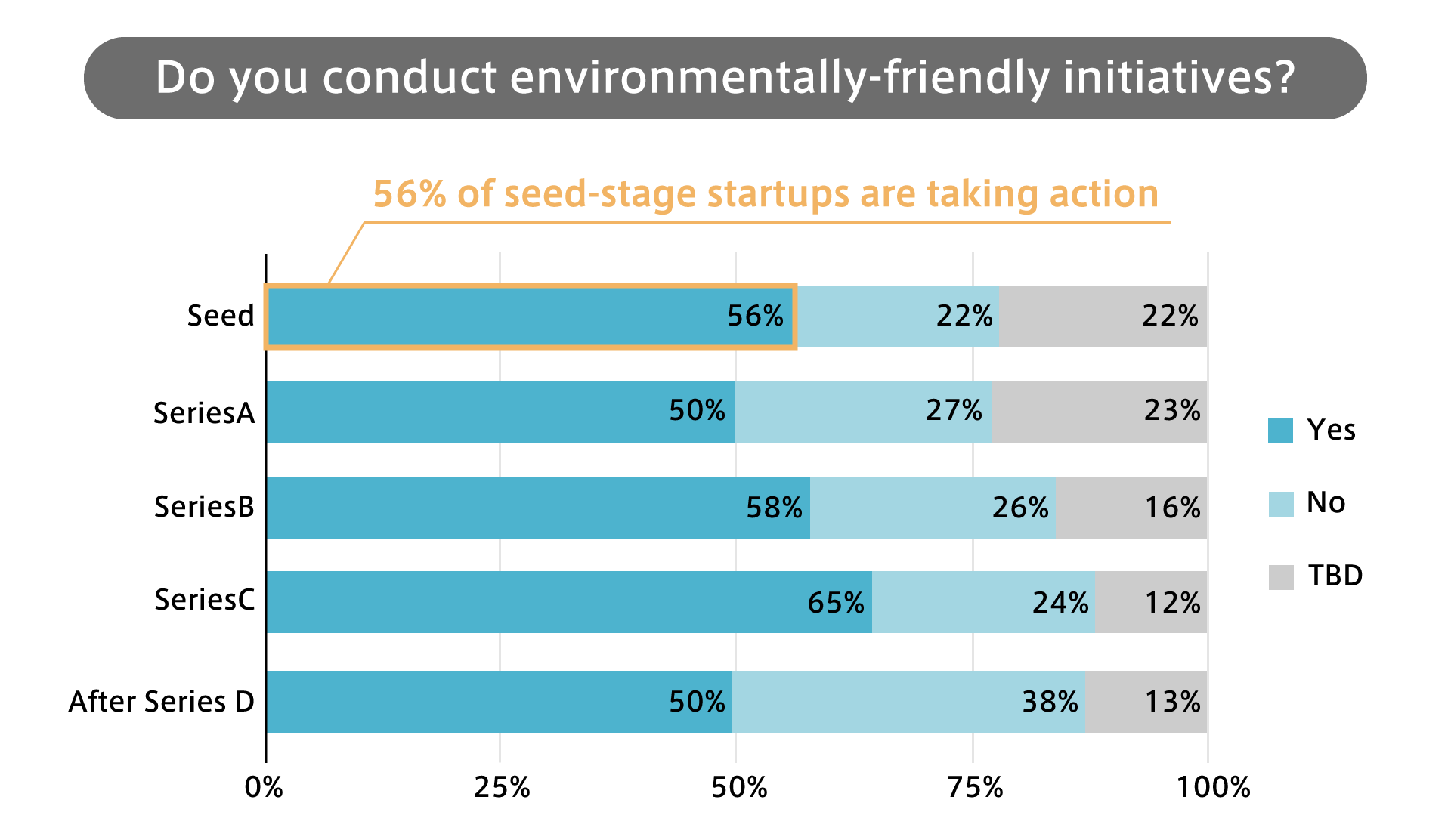

When it comes to questions on the environment, we found out that startups tend to step up their efforts as they advance their business stage.

In particular, the question “Do you conduct environmentally-friendly initiatives?” revealed that startups were very mindful of the environment, with over half of respondents in every stage taking care of the environment.

One thing we should highlight is that even among seed-stages startups with limited resources that have no choice but to focus on product development, 56% are conducting environmentally-friendly initiatives. It is difficult to see the business benefits of environmental measures, and such measures tend to be left behind when the company is in the initial stage of its business, but we can see that the startups’ awareness of environmental protection is consistently high.

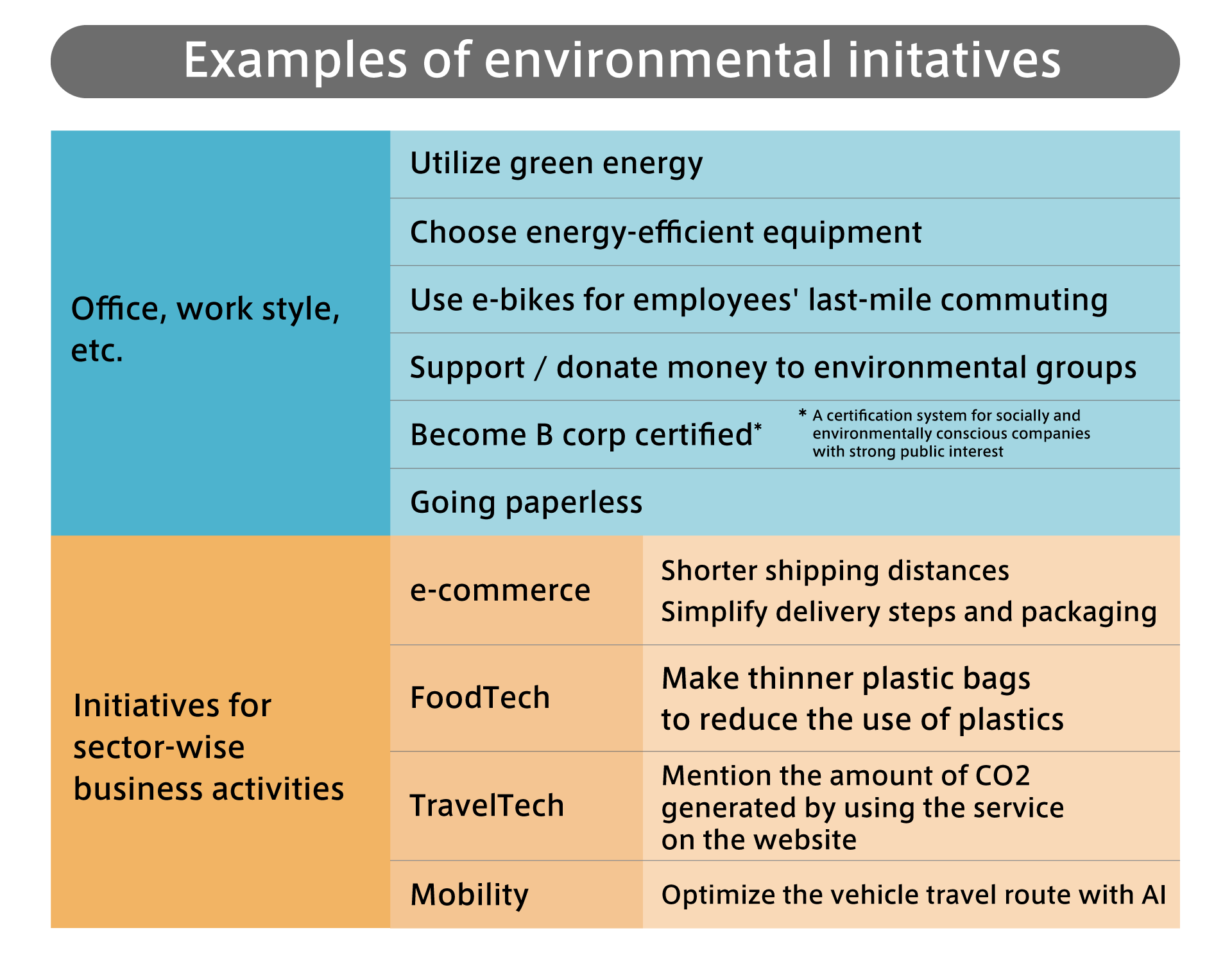

Specific initiatives include the following.

A certain difficulty in establishing an “environmental policy”

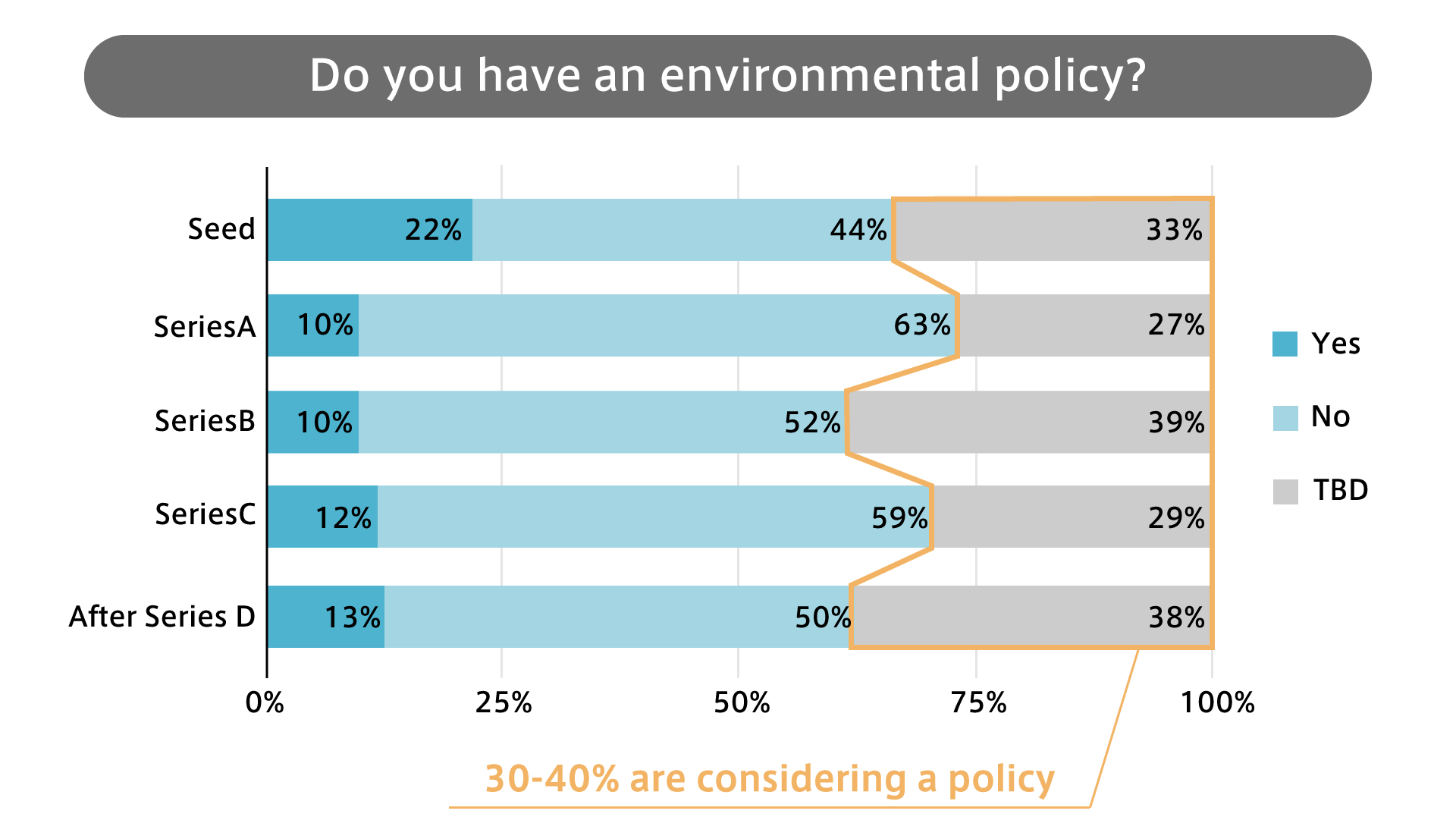

Although respondents are steadily working on environmentally-friendly initiatives, they seem to be facing a certain difficulty in documenting such initiatives to formulate an “environmental policy.”

In the question “Do you have an environmental policy?,” about 40 to 60% of the respondents did not have one, regardless of stage. On the other hand, 30 to 40% responded that they were “considering a policy,” which shows that the necessity of an environmental policy seems to be recognized to a certain extent.

GB hopes to earnestly support startups by giving advice on developing policies, providing examples of other companies, etc.

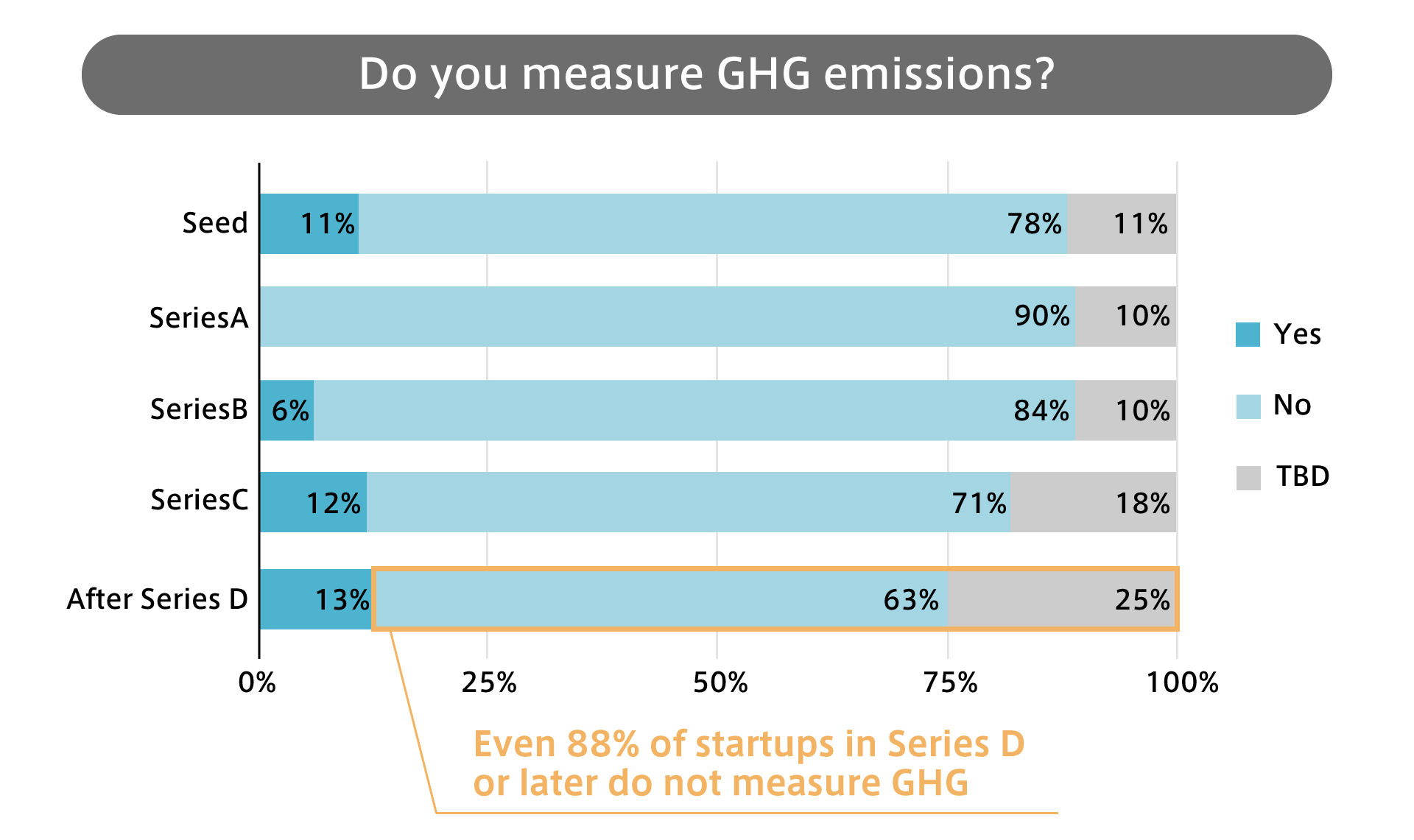

Some startups are addressing the challenging “GHG measurement”

Out of the items on the environment, the most challenging was the “measurement of greenhouse gas (GHG) emissions.” Even for Series D companies, 63% responded that they did not measure GHG emissions.

On the flip side, there are pioneers in this effort. The “GHG protocol,” the most widely used greenhouse gas accounting standard in the world, classifies emissions associated with companies’ business activities from Scope 1 to 3. One Japanese startup measured up to Scope 2, indirect GHG emissions. Moreover, there were overseas startups measuring emissions from procurement of raw materials to after product sales (Scope 3).

We might need to disseminate leading companies’ initiatives within the industry to drive more startups to follow.

Social

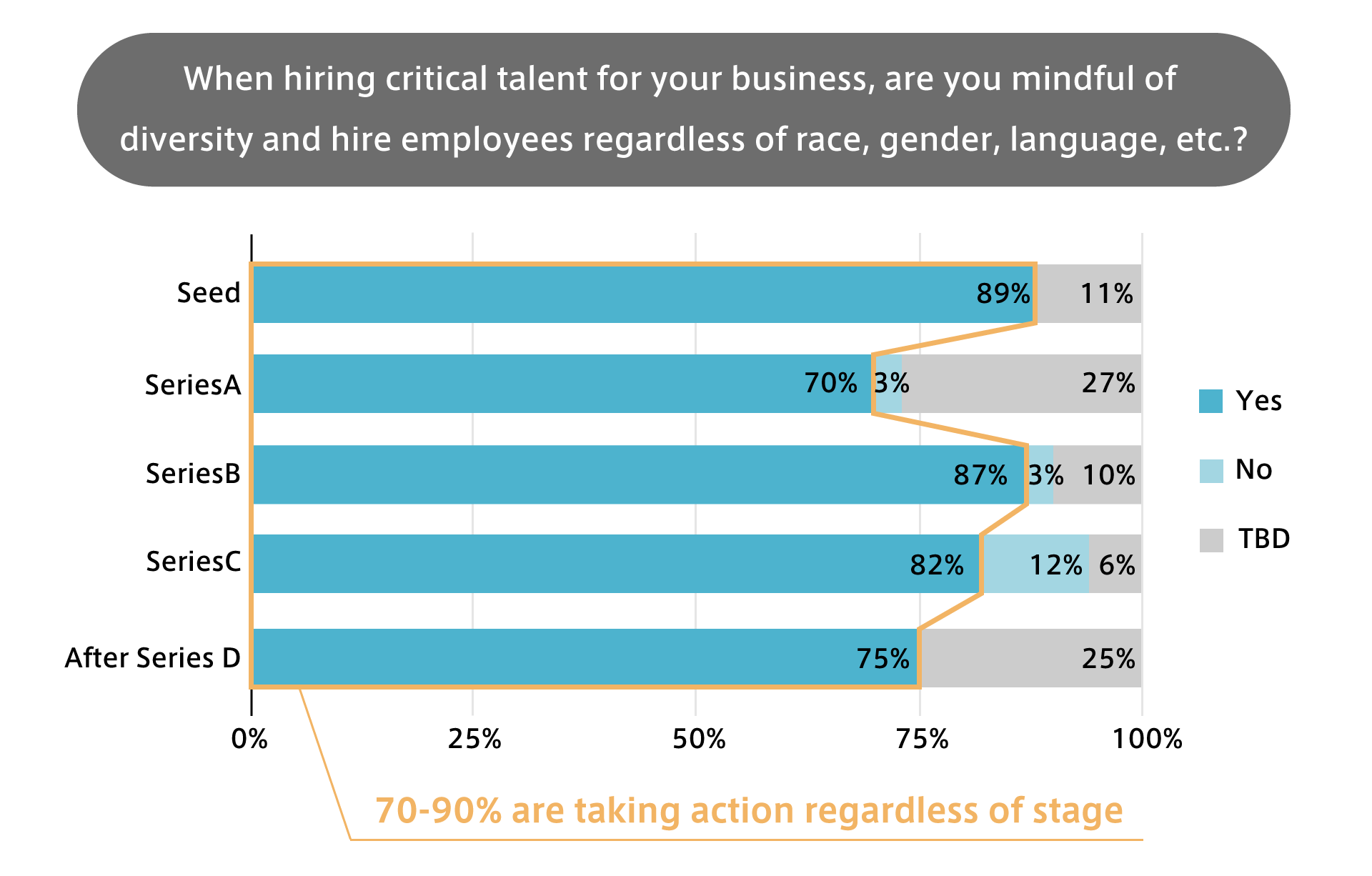

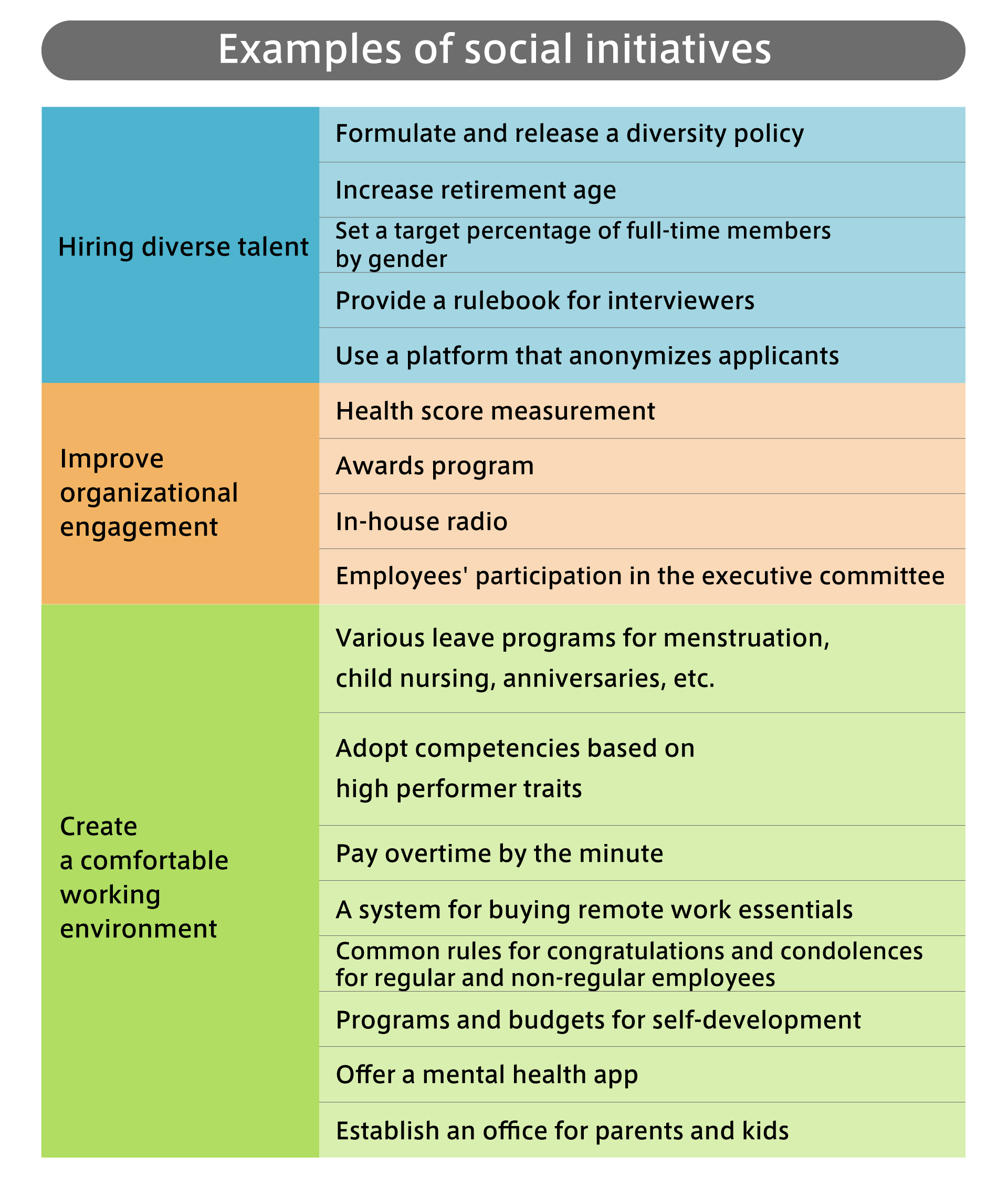

“Diversity hiring” is common across all stages

To the question “Are you mindful of diversity when hiring employees?,” 70 to 90% responded “Yes” regardless of stage. Particularly, the percentage of seed-stage startups that responded “Yes” was the highest, showing that management teams of startups that were founded in recent years are mindful of diversity from early on.

Among them was a startup that has achieved unbiased and fair recruitment by leveraging a platform where applicants are anonymized.

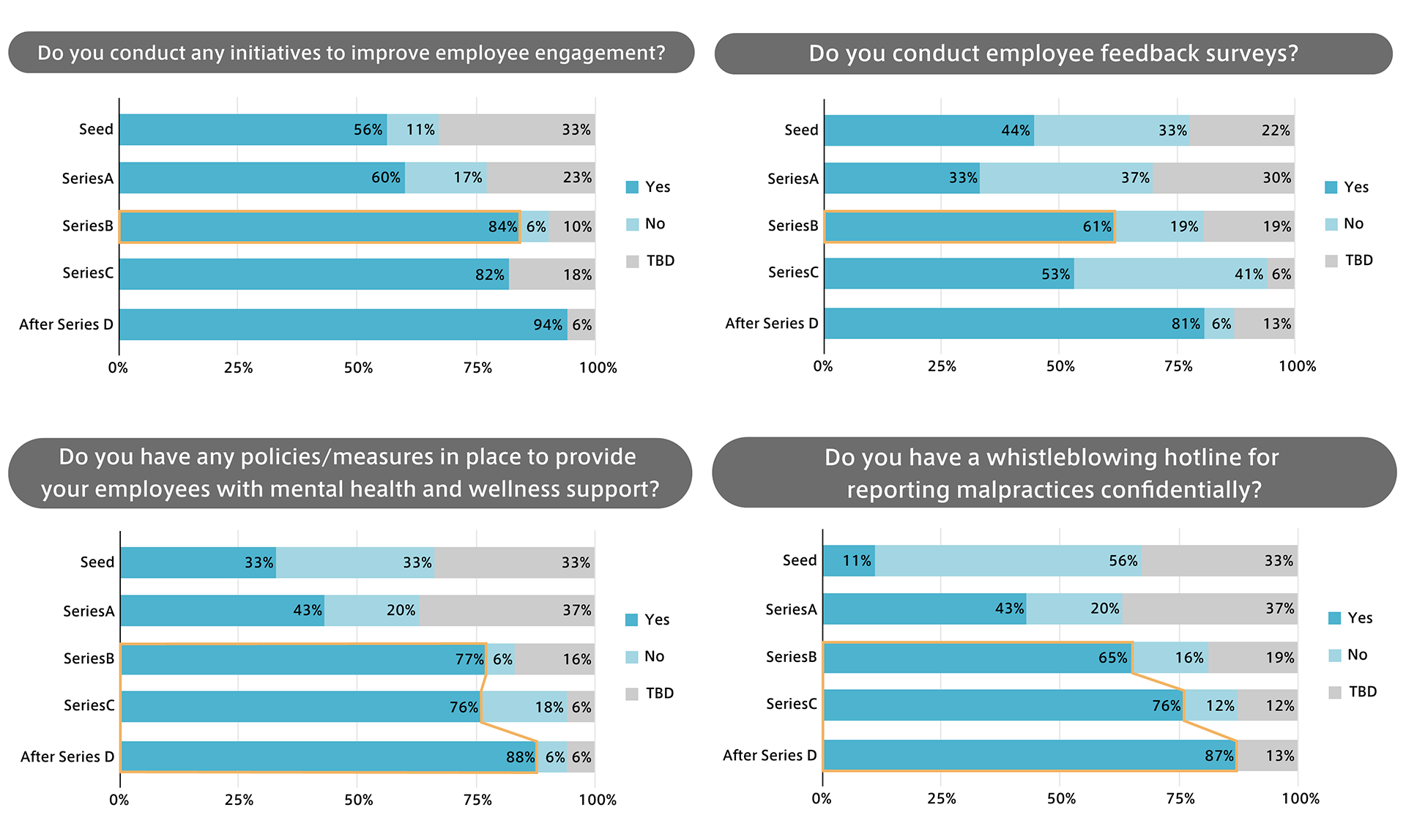

High awareness of addressing organizational expansion

In order for a company to grow over the long term, it is essential not only to recruit diverse talent but also create a vibrant workplace where they can work comfortably and successfully.

When we looked at the implementation status of “initiatives to improve employee engagement” and “employee feedback surveys,” we found that companies tend to put more effort in these initiatives in the later stages of their businesses. Moreover, for both items, the percentage of companies that responded “Yes” significantly grew from Series B, which is said to be the period of time when the number of employees suddenly increases, indicating a high level of startups’ awareness in dealing with organizational expansion.

More than 60% of respondents in Series B to D also provided “support for mental health and wellness” and “employee hotlines.”

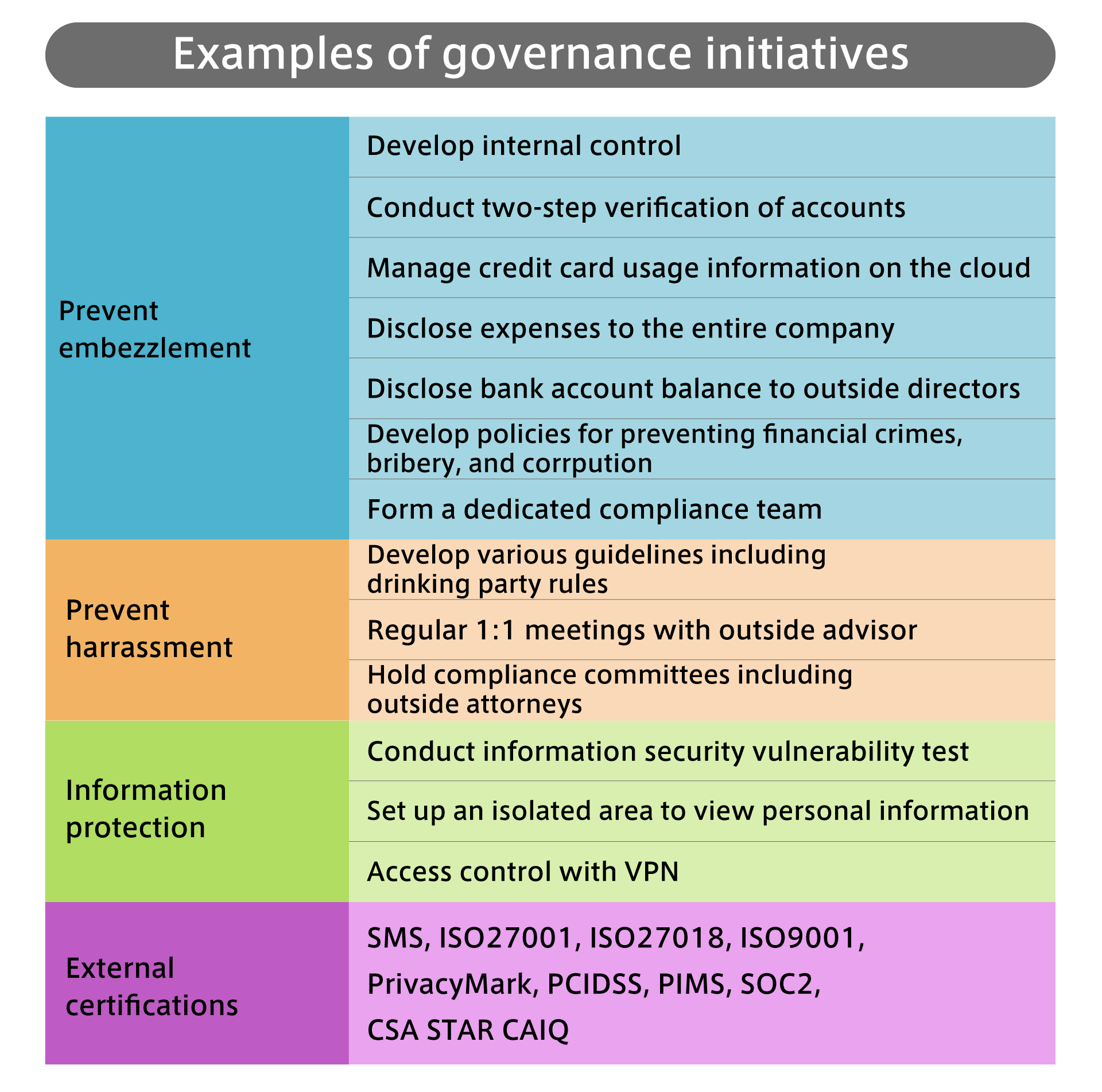

Governance

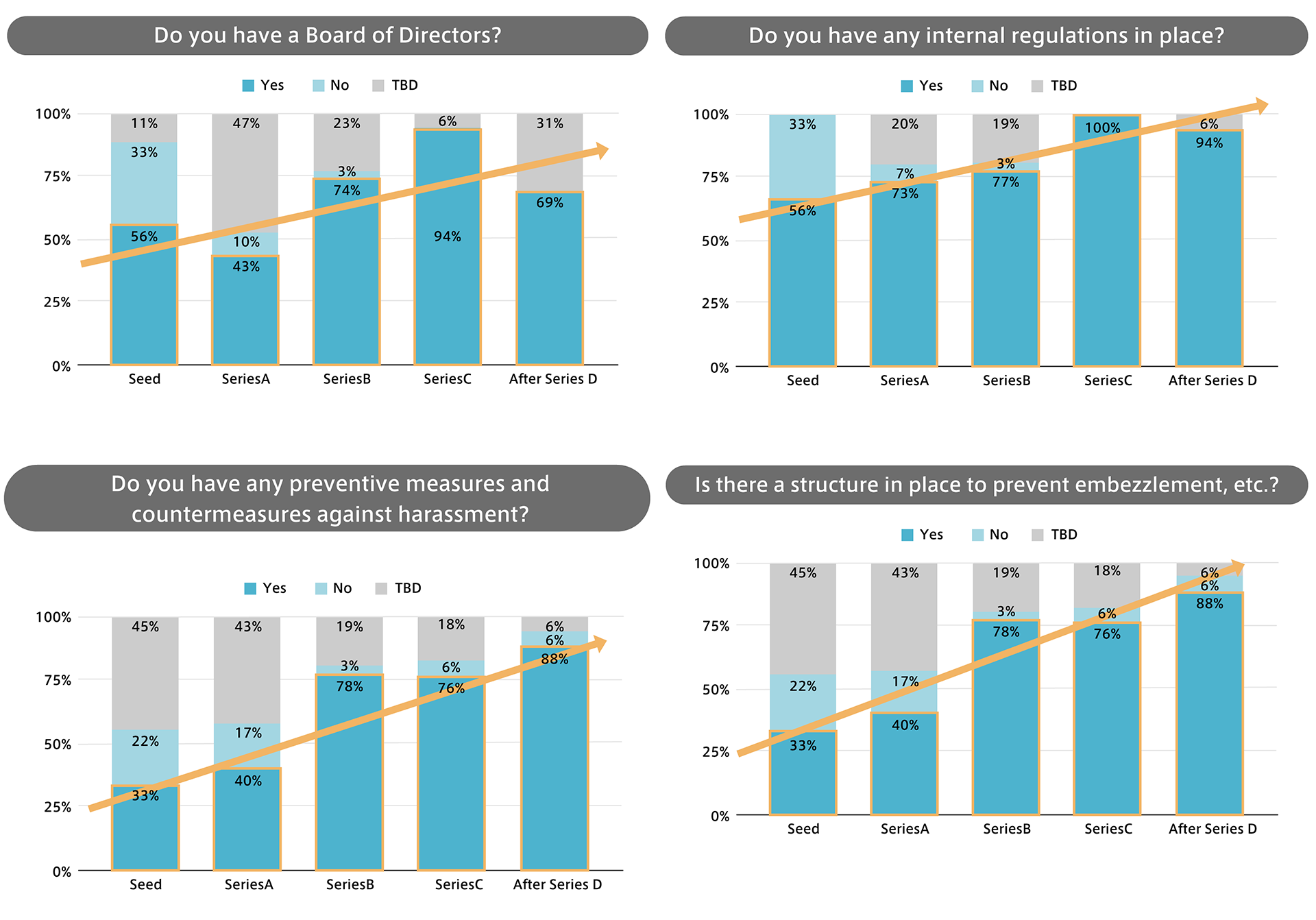

Governance enhanced in later stages

Companies also tend to enhance governance initiatives in later stages.

Enhancing governance is vital for companies to achieve sound organizational management while continuing to grow their business. Although it can be difficult for early-stage startups to address governance with their limited management resources, Series D respondents said that they were addressing most of the items.

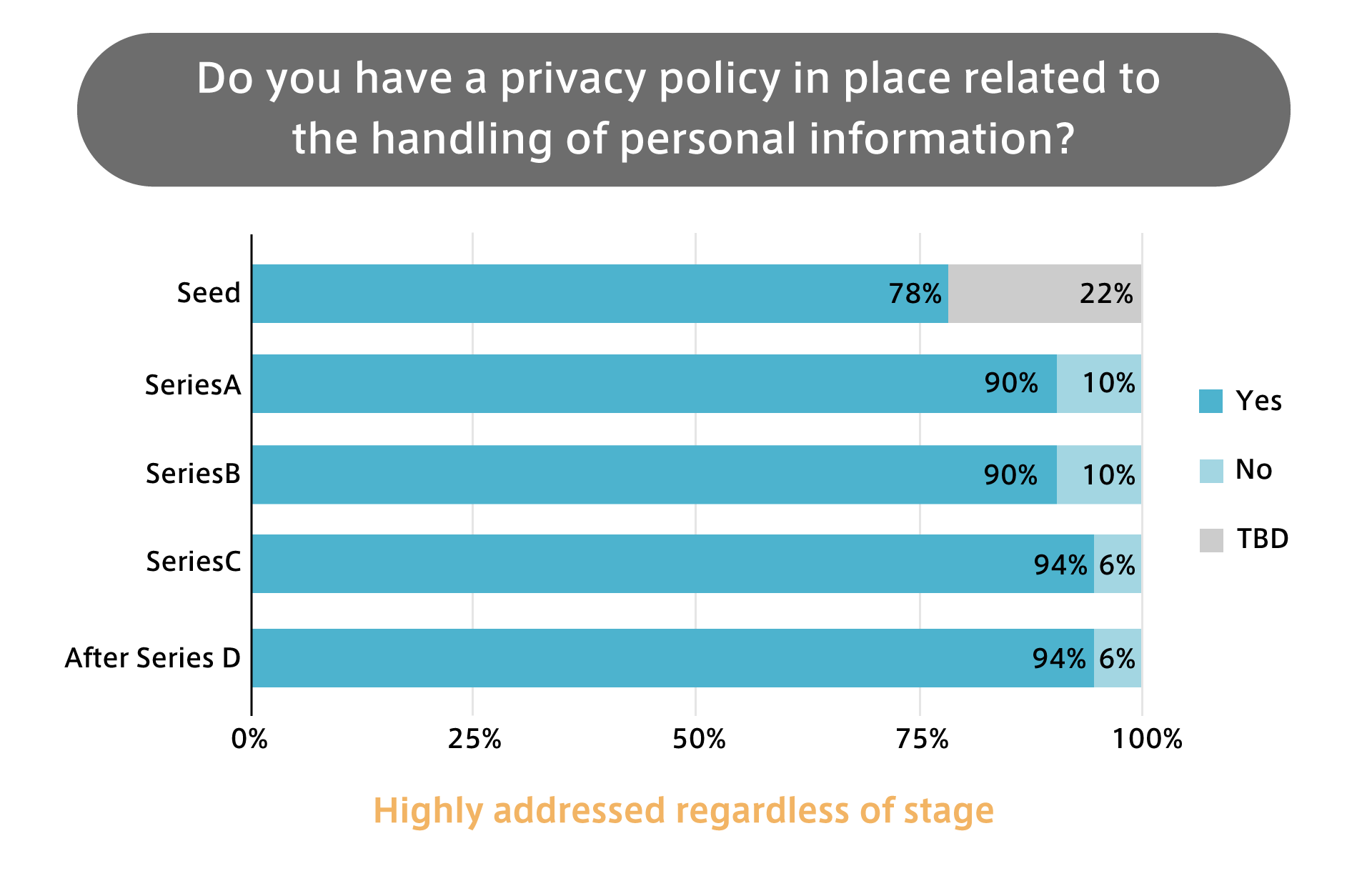

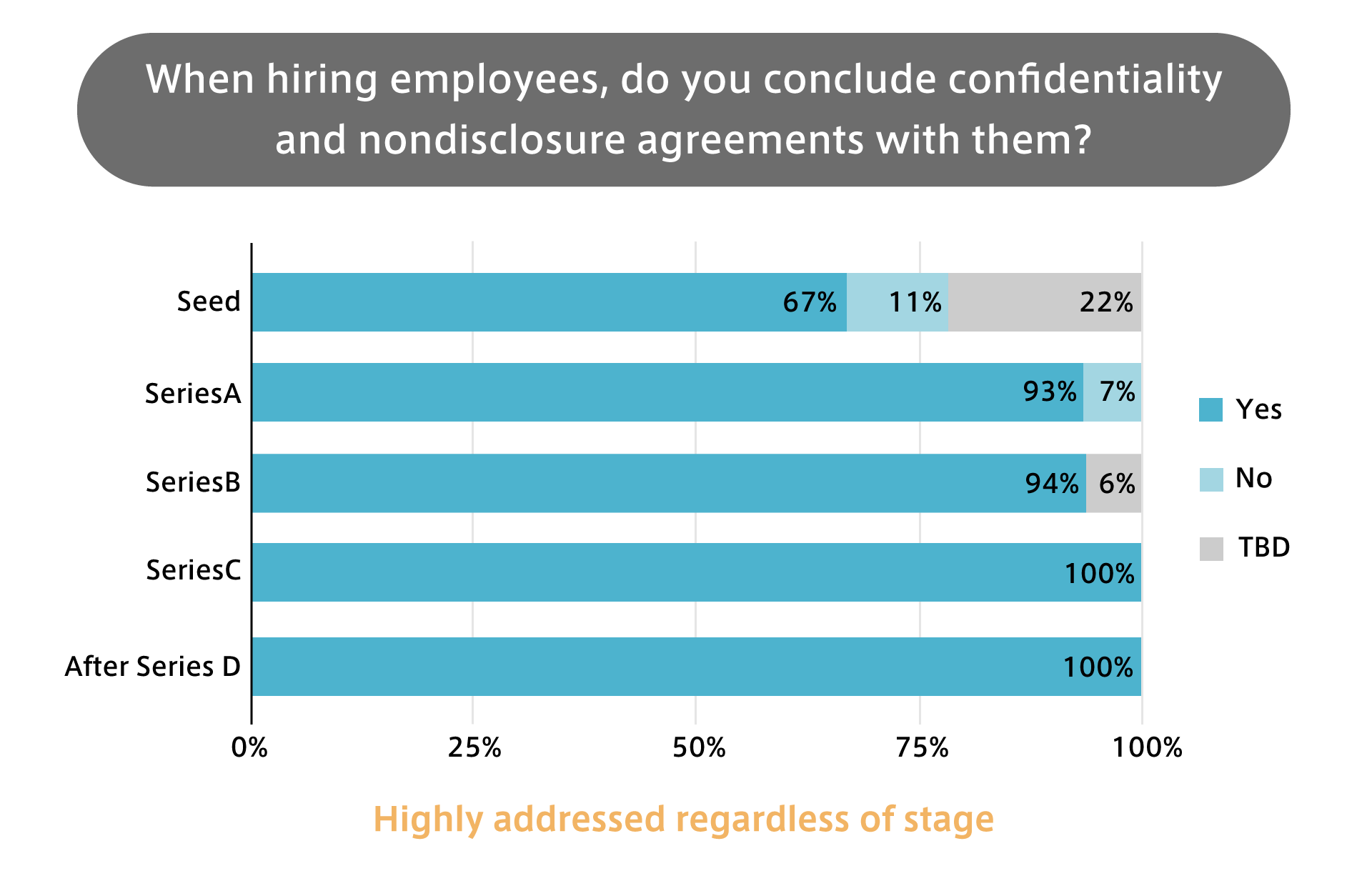

Widespread awareness for a privacy policy and nondisclosure agreements

The percentage of companies that address privacy protection and non-disclosure agreements is high even for early-stage companies, indicating that the need for addressing these items seems to be strongly acknowledged.

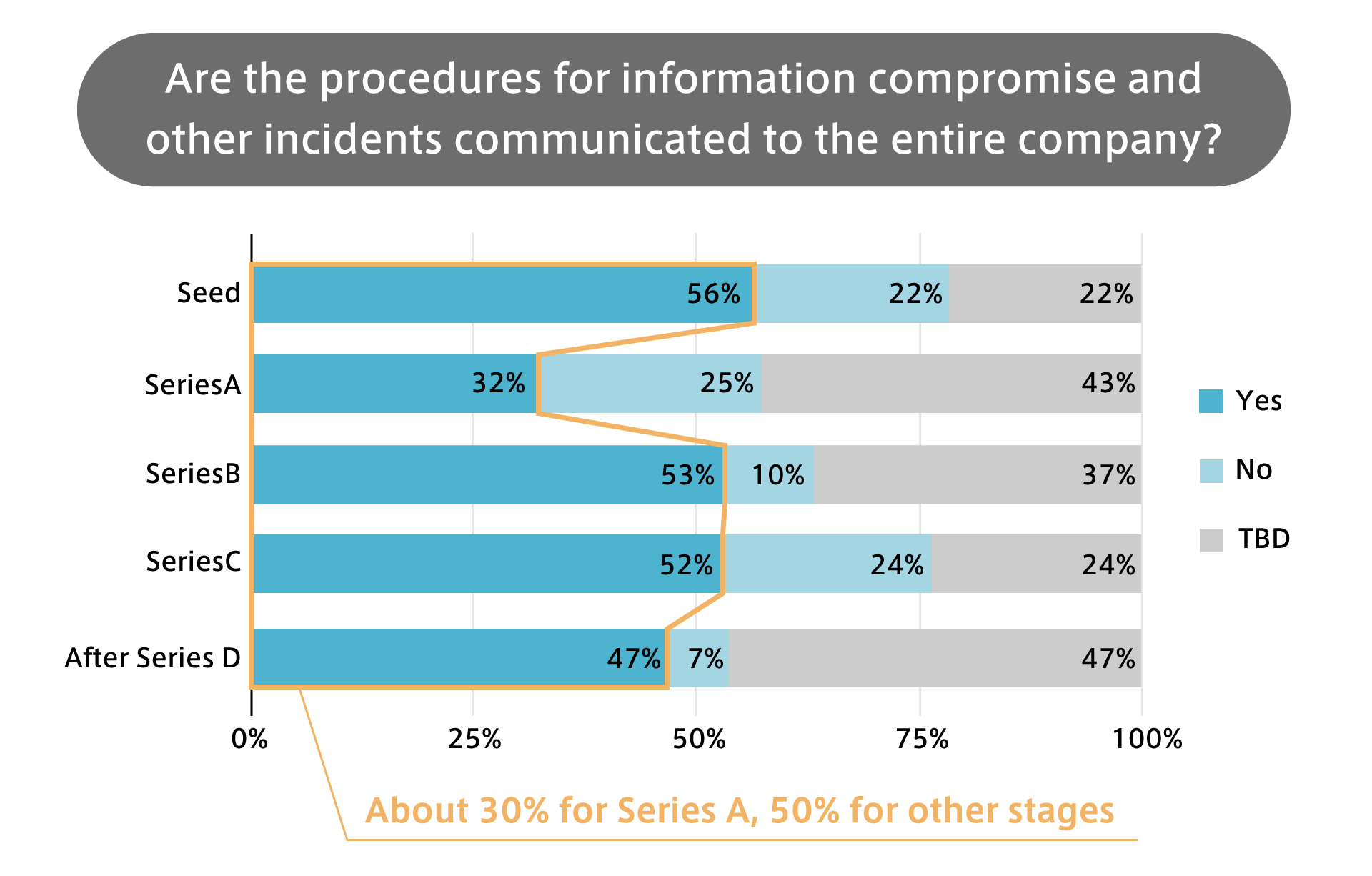

On the other hand, only about 30% of Series A companies and 50% of companies in other stages had procedures in place for responding to incidents.

Remote working is becoming more common among startups, but it is also important to have accompanying rules in place, as well as procedures for responding to incidents.

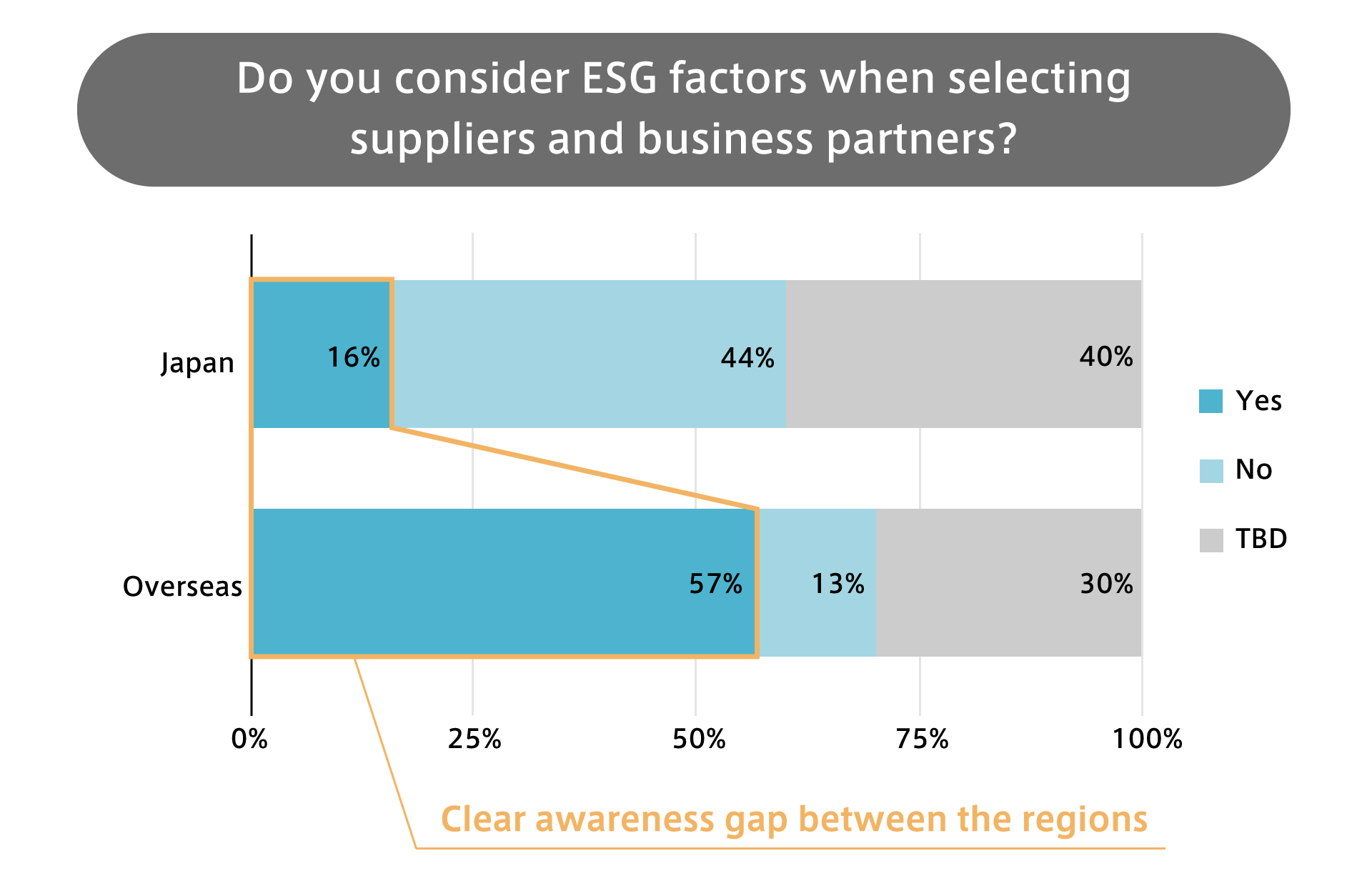

Clear difference between regions in “selecting partner companies based on ESG”

Among the governance-related items, many Japanese startups in particular found it difficult to “select business partners by considering ESG factors.” Only 16% were addressing it. We analyzed the answers by series, industry, and headcount but found no clear trend. It can be said that this is an area where Japanese startups as a whole are lagging behind.

On the other hand, nearly 60% of overseas respondents said that they consider ESG when selecting partners, highlighting the difference in awareness between regions.

GB will further support startups in increasing ESG awareness

GB plans to continue conducting ESG surveys in the future. Some of the respondents said that it made them realize that there were still more they can do, and we believe that conducting the survey contributes to increased awareness and growth of startups from a long-term perspective.

While startups aiming to go public will be required to disclose ESG information in the future, best practices for each stage are not yet widespread. GB will expand the scope of funds that conduct ESG interviews, aiming to understand the state of all the portfolio companies’ ESG practices. We hope to give back the knowledge we gained to startups.

GB will continue to take various actions to help startups become truly sustainable so that they can shape the future.

Nagisa Shigetomi

Global Brain

Investment Group

Director

Nagisa joined GB in 2018 and is responsible for the entire process of sourcing, investment execution, and support for Japanese and overseas startups. She also supports startups and major business companies in fostering collaboration. As ESG Policy Manager, she has introduced the ESG Policy to the investment examination process and strives to foster ESG awareness in the VC industry.

Kenji Hayashi

Global Brain

Investment Group

Principal

Kenji joined GB in 2023. Kenji was involved in business development and management accounting at Softbank. At NIFTY, he worked in partner sales and service planning.