From the Eyes of an Overseas VC: The Strength and Potential of Japanese Companies in the African Market

This article looks back on the 2023 African market and explores the continent’s synergies with Japanese companies. We were joined by Kola Aina and Dotun Olowoporoku from Ventures Platform, a leading venture capital firm in Africa.

Written by Hiroto Sorita, edited by the Universe Editorial Team

This is Hiroto Sorita from Global Brain (GB), responsible for investing in African startups.

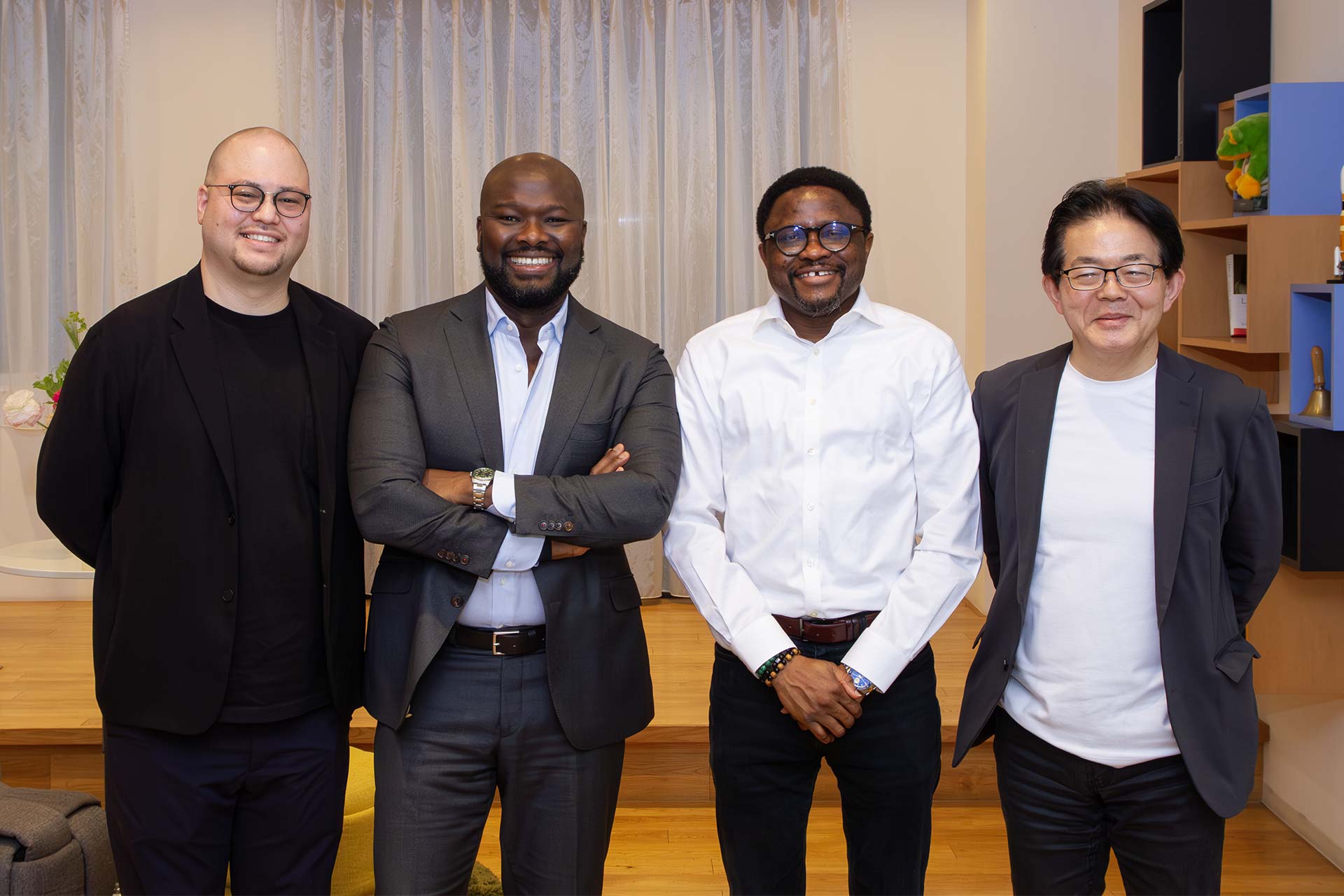

Partners of Ventures Platform, a venture capital firm investing in Africa, visited our office last month. I would like to share our discussion with them on the topic of “the synergy between Japanese companies and African startups.”

The frontline of African startups

Ventures Platform, located in Nigeria, is one of the most well-known venture capital firms in Africa. The firm has invested in over 100 African startups and manages more than 75 active portfolio companies.

This time we welcomed Kola Aina and Dotun Olowoporoku at our Tokyo Office. Kola is the founder of Ventures Platform and a venture capitalist with a track record of investing in Paystack which was later on acquired by Stripe. He chairs the board of a community of angel investors mainly in Lagos and volunteers to advise the Nigerian President to boost the startup economy.

Dotun has worked with GB before for Ventures Platform’s coinvestment with us in Mecho Autotech. He is among the few venture capitalists in Africa coming from an academic background. (A Ph.D holder).

On the day of their visit, Kola and Dotun first met with GB’s CEO Yasuhiko Yurimoto. Yuritomo and the two shared their firms’ characteristics and strengths, exchanged questions, identified various commonalities around their strategies and visions, and agreed to deepen their relationship by sharing knowledge and experience going forward.

How a local venture capital firm sees today’s African market

From here onwards, I would like to share the details of the discussion we had with Ventures Platform on the topic of collaboration between the African market and Japanese companies. (The questions in bold were all asked by the Universe Editorial Team.)

──How would you explain the African market looking back on 2023?

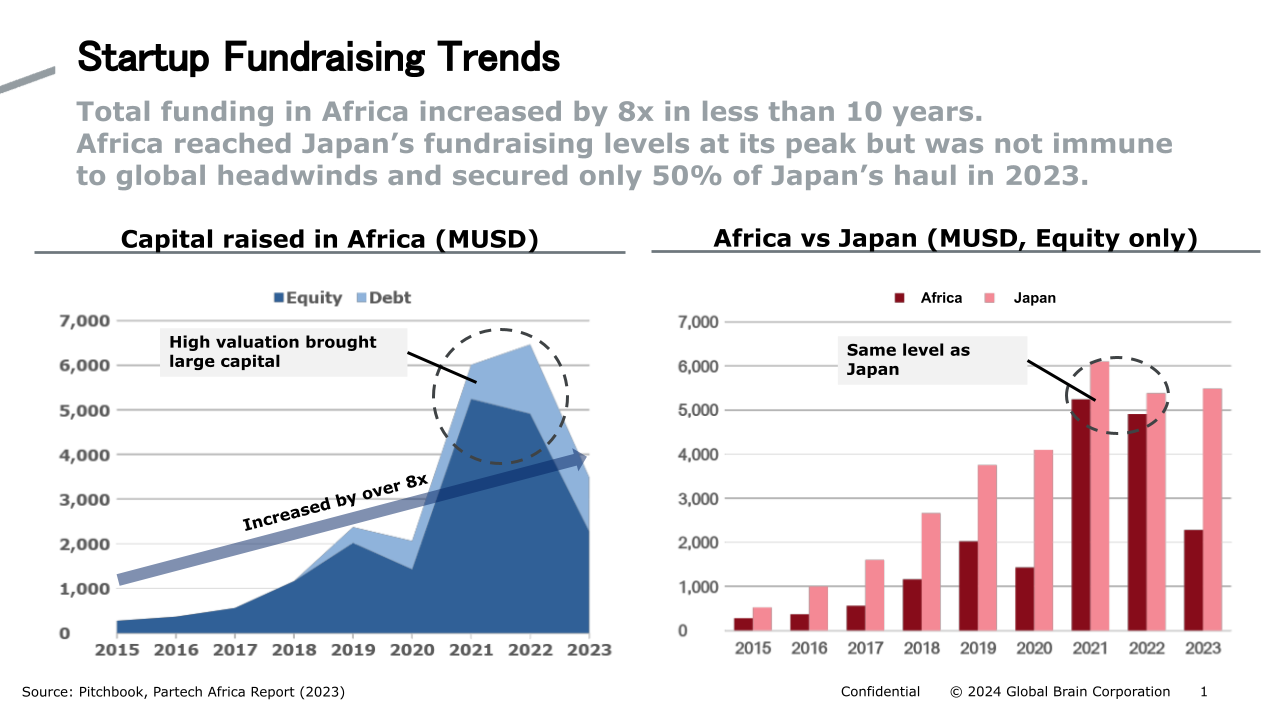

Kola: 2020 to 2022 were post-covid years and the African market experienced significant growth triggered by hot money. However, last year was a year of recalibration and the market was pulled back to normal levels. Valuations were high before 2023, but cooled last year.

In Nigeria, valuations dropped in 2023. More deals were done but they were at small, modest valuations. We saw some companies struggling to raise money and also many extension rounds.

However, that does not mean we didn’t see growth in Africa. The Central Bank of Nigeria temporarily stopped the use of old naira (Nigerian currency) notes which caused great confusion, but at the same time, a change in the government’s policy spurred the growth of fintech. (As of now, the old bank notes remain legal tender. ) Another trend we saw was a flow of capital into Egypt and Kenya, a phenomenon contrary to what we saw in the past four to five years where money mostly came into Nigeria.

All in all, I would say it was a year of mixed trends, but I also think it was a year where “the market was reset and normalized.”

Hiroto: Yes, I also feel the valuation was standardized. Global investment in African startups saw a hype in the years 2021 and 2022. African startups had very high price tags compared to similar startups in Southeast Asia that GB has invested in before, and we passed on investing in some companies given the high risks. We can say the market was overheated partly due to the inflow of foreign capital mainly from the US.

Kola:Oftentimes, markets get distorted by external participation. I can say it was a learning experience for many African companies.

Hiroto: I personally feel that startups that are growing despite this environment are the ones who are truly resolving market pain points, have management teams capable of getting things done, and where we should be investing in.

──Any areas or companies that Ventures Platform is looking at right now?

Dotun: At Ventures Platform we do not confine ourselves to specific sectors, but we spend a lot of time looking at AI and climate tech. We are exploring future generative AI use cases in Africa and the implications AI has on our portfolio companies.

We are also actively looking for climate tech companies, as climate change is a big issue that impacts our future. We also look at how our existing portfolio companies are working to reduce their impact on the planet. For companies in both sectors, the key is whether they are capable of bringing market-creating innovation.

Kola: Another sector we are excited about is healthcare. African youth is going to be the majority of the world in the future. To make sure that the population is not draining on the world’s medical care resources, we need to grow the health tech sector. We are also interested in genomics.

Africa needs the “long view” of Japanese companies

──Japanese companies have been very active in Africa in the past few years. For example, SBI Holdings invested in an African venture capital firm, Sumitomo Corporation launched an accelerator program with a local telecommunications operator, and Yamaha announced an investment in a Nigerian startup. What should Japanese companies be mindful of when collaborating with African ecosystem players?

Kola:During our visit to Japan we have met with many companies that have long histories, and they speak about resilience, patience, and long views. We often say that the African market is still Day 1 so the partners we need are long-term partners and not the kind of companies that are just being opportunistic. Japanese companies have patience and resilience. That is something we think is fitting with African needs.

That said, because some African regions and sectors are still in their early stages, domestic regulations are yet to be structured and the market is transforming every day. I would advise Japanese companies to find reliable local partners who can address sudden market changes if they want to succeed in Africa.

Bring patience and a long-term view, marry with a trustable local partner, and the chances of succeeding in a strategic relationship will be a lot higher.

Dotun: Finding a local partner is critical. Africa consists of 54 independent countries and not states. To have a successful business, you need a partnership with a player who knows each country in depth.

──Hiroto, having worked in Africa on an overseas assignment, what do you think Japanese companies need to be mindful of?

Hiroto: Japanese companies that have not yet entered Africa will find it very difficult to get local information in this vast land. When such companies start thinking about doing business, they should aim for “small and quick” starts to enter the market.

When companies consider investing in African startups, I would like them to especially focus on “Egypt” and “Nigeria’’ out of the big four (Nigeria, Egypt, Kenya, and South Africa). They may of course be concerned about country risks, but since only a handful of Japanese companies have expanded their businesses into these two countries, they could still get the upper hand as pioneers in these markets. These two nations have the top two GDP in the continent and have given birth to almost all the unicorns in Africa, which means we can expect more liquidity here than in other African countries.

Wrap-up

The two Ventures Platform partners shared positive views about the synergy between Japanese companies and Africa. Large Japanese companies have been taking the lead in establishing a long-term relationship with Africa. We can say that this wave of collaboration is now flowing into the startup sector.

As one who has been involved in African business deeply since my previous job before GB, I feel truly happy to see the collaboration happening in the startup sector. I look forward to continuing exchanging updates with Ventures Platform to co-invest in superb African startups like Mecho.

More to come on African startups in GB Universe. Stay tuned.

(Follow our Global Brain’s official X account to get updates on GB Universe articles.)

References

Partech Africa. “Partech Africa Report 2023”. Partech Africa. 2024-01-23. https://partechpartners.com/africa-reports/2023-africa-tech-venture-capital-report, (Date accessed: 2024-02-28)

Hiroto Sorita

Global Brain Corporation

Investment Group

Director

Hiroto joined GB in 2021 and is responsible for sourcing, investment execution, and post-investment support for African startups mainly in Egypt, Kenya, Nigeria, and South Africa.