Fintech Is Driving Africa's Economies

Egypt has recently been praised for its efforts to establish an environment conducive to fintech growth and greater financial inclusion. We will look at the latest developments and explore how Japanese companies can capitalize on this trend.

Written by Hiroto Sorita, edited by the Universe Editorial Team

This is Hiroto Sorita from Global Brain (GB), responsible for investing in African startups.

You may have heard people saying, “Not many people have bank accounts in Africa, and money transfer through mobile phones is popular.” An embodiment of that is M-PESA, which was launched by mobile services provider Safaricom in Kenya in 2007.

At present, the number of monthly active M-PESA users in Kenya is 34.6 million, which exceeds the country’s working-age population (around 30 million). This means that practically all Kenyan people are using the service. Since the country’s financial infrastructure was underdeveloped, and many citizens did not have bank accounts, M-PESA spread throughout the country rapidly, allowing users to send money anywhere in the country with their mobile phones.

The advertisement run at the time of M-PESA’s launch easily communicated its value for users. (It starts from around 9:30 in this video.)

The rise of M-PESA is credited with inspiring the expansion of money transfer and other fintech services in other developing countries, particularly in Africa, allowing countries with limited infrastructure and legacy services to leapfrog more developed nations in mobile money use.

Compared to other African countries, Egypt has made significant strides this year in establishing an environment for fintech growth. This year could be the “dawn of fintech” in Egypt. We are going to explore why fintech is likely to grow in Egypt, what are the possible changes, and how Japanese companies can capitalize on this trend.

Three reasons why Egypt could be seeing the “dawn of fintech” this year

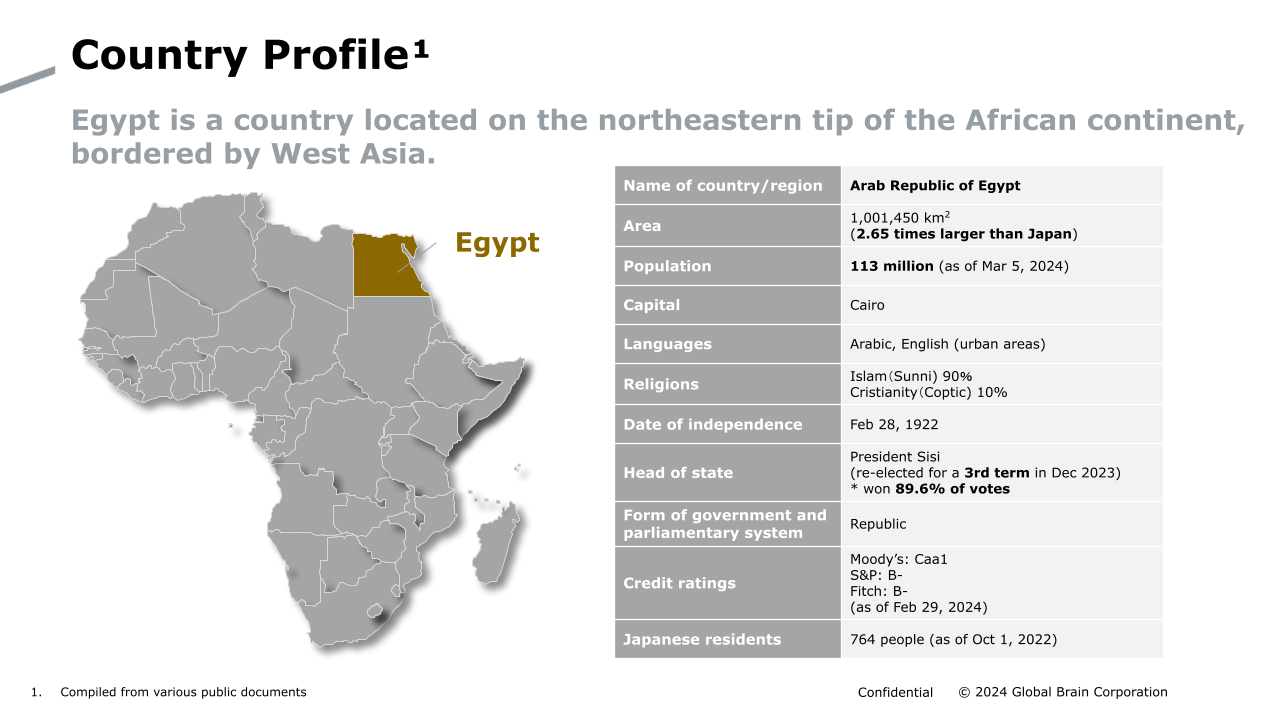

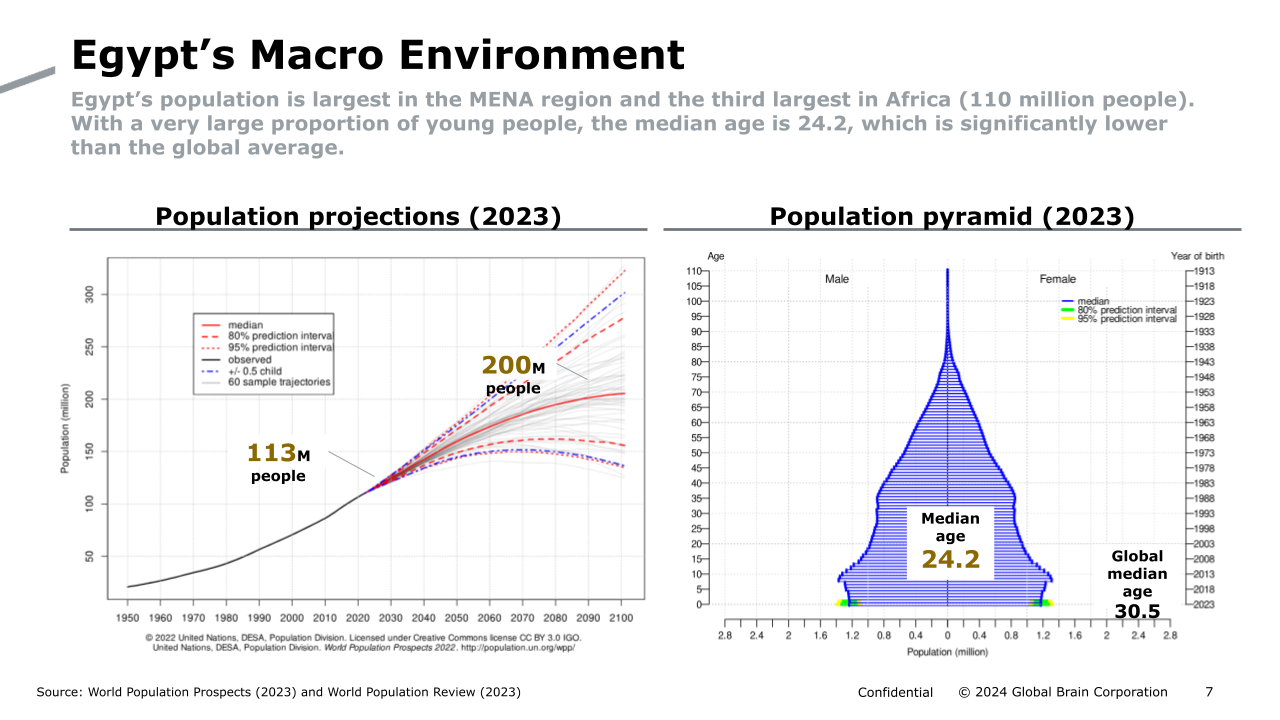

Egypt’s size is 2.65 times that of Japan, and it is the third largest country in Africa, with a population of 113 million. Its median age is 24, which means the country has many young people, and the population is expected to grow naturally through 2100. The total population of its capital, Cairo, and a nearby city, Giza, is approximately 22 million, which is approximately twice the population of the 23 wards of Tokyo.

There are three main reasons why this year could be the “dawn of fintech” in Egypt.

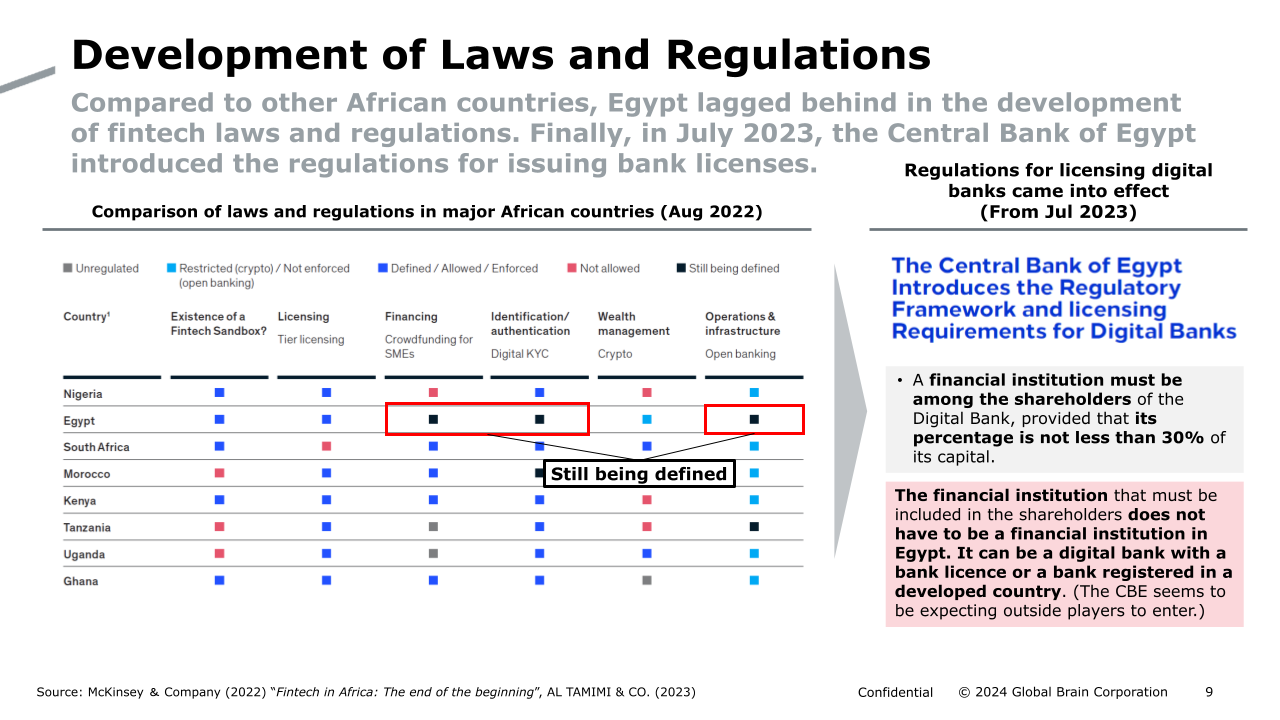

1. Development of fintech-related laws and regulations

The first is the enactment of regulations for licensing digital banks.

Until now, Egypt lagged behind other African countries in the development of fintech-related regulations. One of the reasons for this is that state-owned banks have held nearly 70% market share of domestic banks. State-owned banks have struggled for many years to drive open innovation in banking services. As a result, the quality of banking services has lagged behind much of the world, and the use of bank accounts was not adopted by most people, resulting in relatively low financial inclusion. McKinsey & Company’s report “Fintech in Africa (2022)” noted that Egypt’s fintech laws and regulations were “still being defined” as at August 2022.

To help address the situation, in July 2023 the Central Bank of Egypt (CBE) issued regulations regarding the licensing of digital banks, and refined other related regulations, with the aim of shifting from a highly cash-dependent to more digitalized financial system, and increasing financial inclusion. As a result, the regulatory foundation for digital banks and other fintechs in Egypt was established quickly.

One notable point of these regulations is the following condition: “A financial institution must be among the shareholders of the Digital Bank, provided that its percentage is not less than 30% of its capital.” At first glance, it appears to be a preferential measure for domestic banks in Egypt, but financial institutions registered in other countries are included.

The CBE seems to be expecting outside players to enter, spurring competition and development of fintech services. The regulations are widely viewed as a positive development in Egypt.

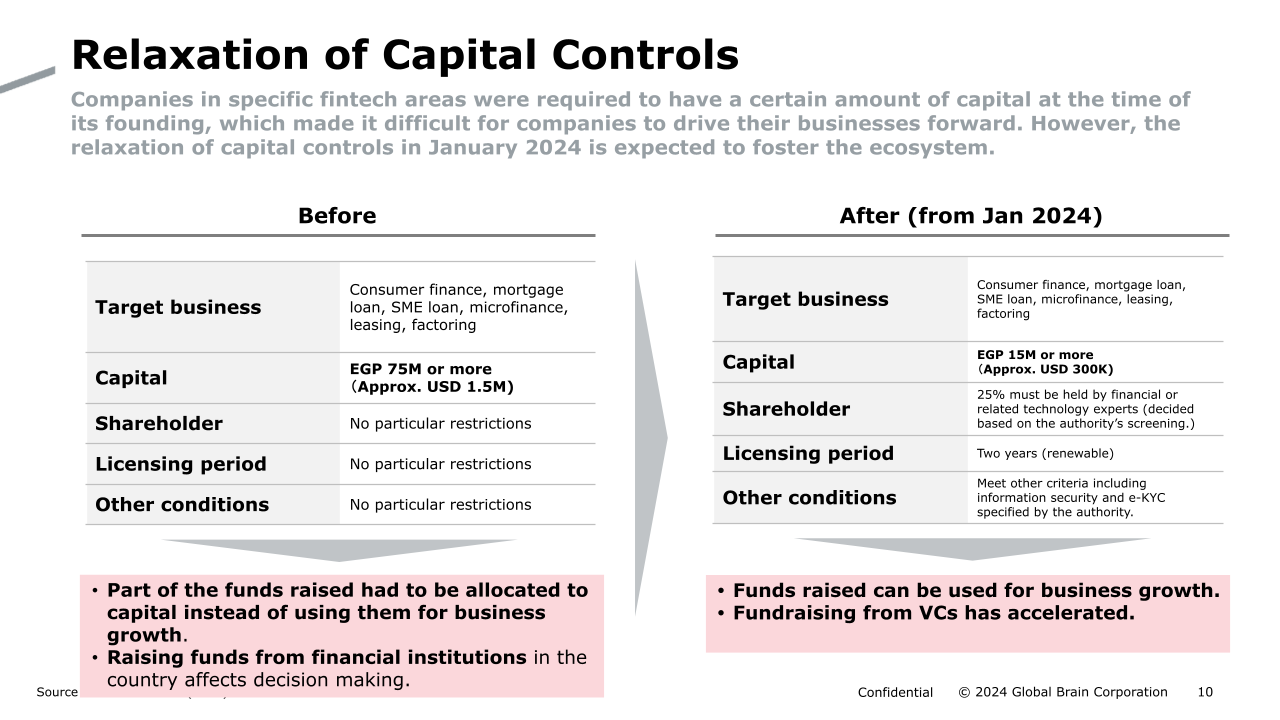

2. Relaxation of capital controls for founding fintech startups

The second is the relaxation of capital controls for establishing a fintech company.

The digital banking and fintech regulations were received positively, but there was an unexpected, relatively onerous hurdle, which was the initial capital requirement, set up to encourage collaboration with major financial institutions.

The regulations initially required companies in specific business areas such as consumer finance, mortgages, and SME lending to have a significant amount of invested capital at the time of establishment, amounting to approximately US$1.5 million. This capital requirement made it more difficult for fintech startups looking to provide these services.

In January 2024, the government revised the capital controls, reducing the required capital to start a relevant business to one-fifth of the initial amount. This has boosted fintech startups.

3. “Instapay” is accelerating digital payments

The final reason is that the CBE is strongly supporting financial inclusion (efforts to ensure that more people can access basic financial services).

One of the CBE’s actions was the launch of a payment service called “Instapay” in 2022, which allows P2P (peer-to-peer: a communication method that allows data to be exchanged between PCs and smartphones without going through a server) payments on mobile devices. The number of Instapay users has reached 6.2 million, with 300 million transactions to date according to the government.

The CBE took the initiative to launch this service following the success of similar government initiatives in India (UPI), Brazil (Pix), Thailand (PromptPay), China (IPBS), and Korea (HOFINET). It’s a positive example of a government showing committment to greater financial inclusion and enhanced, tech driven financial services. In Japan, this would be as if the Bank of Japan launched a consumer service.

Momentum for fintech growth in Egypt is increasing, supported by the government’s initiatives.

Possible changes in a leading fintech country

The acceleration of fintech will bring positive changes to people’s lives.

First of all, we will likely see enhanced financial literacy and the emergence of new services. In Egypt, the number of startups offering Buy Now Pay Later (BNPL) services has increased over the last few years. Players include Sympl and BLNK. Other fintech startups are getting more and more attention, including Rise, Global Brain’s portfolio company that is bringing tech led innovation to financial services in Egypt and the region, and Swypex, a company in which Accel, one of the top VCs in the US, has invested.

As I mentioned earlier, more innovative services than those in developed countries may emerge and spread quickly across the various markets in Africa, and Egypt is quickly evolving into a potential fintech hub for the region.

In fact, some Japanese companies are already trying to be the first to support some of these innovations in Africa. In November 2023, Sumitomo Corporation launched an accelerator program with Safaricom.

The spread of mobile fintech services will accelerate smartphone use, and mobile services and apps in general. In the greater Cairo area, densely populated by young people, popular services can spread quickly. This demographic tailwind may enhance the growth and evolution of digital services, financial or otherwise.

As the number of fintech and other tech start-ups increases, the need for funding will also increase. This may present new, attractive opportunities for Japanese financial institutions that continue to deal with a low interest rate environment at home.

Japanese companies are already taking action

As we have seen so far, Egypt has established an environment that can enable the fintech space in the country to leap forward. In addition to the substantial growth we are witnessing in the financial services market, the digital market could also turn out to be a very large one, providing many opportunities for Japanese companies to enter the Egyptian market.

Some initiatives of Japanese companies might be helpful for many companies as the first step in developing their business strategy in Africa. SBI Holdings and Mitsui O.S.K. Lines have invested in Novastar, an African VC, and with that are getting access to promising African startups and useful local market insights.

Stay tuned for more insights on GB Universe as we cover updates on African startups and key points for Japanese companies to consider when expanding into Africa.

(Follow our Global Brain’s official X account to get updates on GB Universe articles.)

References

- McKinsey & Company. “Fintech in Africa:The end of the beginning”. McKinsey & Company. 2022-08-30. https://www.mckinsey.com/industries/financial-services/our-insights/fintech-in-africa-the-end-of-the-beginning

- Safaricom.“Safaricom PLC FY24 INVESTOR PRESENTATION”. Safaricom. 2024-05-09.https://www.safaricom.co.ke/images/Downloads/FY24-Investor-Presentation-9th-May-2024.pdf, (Data accessed: 2024-07-09)

- The Central Bank of Egypt. “The Central Bank of Egypt Issues Regulations for Licensing and Regulatory Framework for Digital Banks”. The Central Bank of Egypt. 2023-07-12.https://www.cbe.org.eg/en/news-publications/news/2023/07/12/14/38/press-release-12-july-23, (Data accessed: 2024-06-10)

- Sumitomo Corporation. “Launch of Accelerator Program in Africa in Collaboration with Safaricom and M-PESA Africa”. Sumitomo Corporation. 2023-11-08. https://www.sumitomocorp.com/en/jp/news/topics/2023/group/20231108_2, (Data accessed: 2024-06-10)

- SBI Holdings, Inc. “Announcing Strategic Capital Alliance Agreement with Novastar in Africa”. SBI Holdings. 2023-11-02. https://www.sbigroup.co.jp/news/2023/1102_14197.html, (Data accessed: 2024-06-10)

- Mitsui O.S.K. Lines, Ltd. “MOL to Invest in Novastar Ventures, One of Africa’s Largest Venture Capital Firms - Expanding Business in Africa, Addressing Social Issues -”. Mitsui O.S.K. Lines. 2024-04-08. https://www.mol.co.jp/en/pr/2024/24050.html

- Egypt Independent. “CBE reveals number of InstaPay users & volume of Egyptian transactions”. Egypt Independent.2023-11-22. https://www.egyptindependent.com/cbe-reveals-number-of-instapay-users-volume-of-egyptian-transactions/, (Data accessed: 2024-06-10)

Please note that some of the articles listed here are in Japanese only and their titles are provisionary translations.

Hiroto Sorita

Global Brain Corporation

Investment Group

Director

Hiroto joined GB in 2021 and is responsible for sourcing, investment execution, and post-investment support for African startups mainly in Egypt, Kenya, Nigeria, and South Africa.