Deciding to Do it Differently: A Japanese Startup Named Things' Growth Strategy to Raise Funds

Things is a Japanese startup that develops PRISM, a platform designed to leverage product knowledge in manufacturing. This article delves into Things’ business expansion efforts pursued with Global Brain’s hands-on support team.

Things, Inc. (Things) develops PRISM, a product for product lifecycle management (PLM: a core system that integrates and manages the entire product lifecycle through centralized product information). The startup was struggling to build enough traction to validate its unit economics for the next funding round, given the lengthy implementation time of the PLM solutions.

To address this, the independent venture capital firm Global Brain (GB)’s post-investment hands-on support team, Value Up Team (VUT) started joint efforts with Things. Focusing on two strategies—enhancement of partner sales and establishment of a new value proposition incorporating GenAI into the product—they succeeded in boosting traction, shortening the sales negotiation phase, and eventually completing the fundraising.

We sat down with Atsuya Suzuki, Representative Director and CEO of Things and Takuji Chida and Kazuya Matsuda of the GB’s VUT to ask about the details of the measures and key points for successful outcomes.

Only three months to yield results

──To start, what were the challenges Things were facing, and what did the sales performance look like?

Suzuki: Back then, I was the only sales representative at Things, attending business meetings every day. While I also had to allocate time for the next fundraising efforts, I was not able to conduct as many business meetings or gain as much traction as I had hoped.

The nature of our product PRISM also made the business more challenging. In fact, PRISM is the first SaaS-native PLM product made in Japan.

Best practices for typical SaaS sales do not work with PRISM—this was the challenge that we were facing. From the customers’ standpoint, implementing PRISM is like replacing a large-scale core system, which only happens once in three to five years, if not a decade. The implementation will not move forward unless it aligns with the customers’ budget cycles.

──In that situation, what led you to start working with VUT?

Suzuki: I discussed the challenge we were facing with Hayashi-san, GB’s venture capitalist and contact person, and clarified what needs to be achieved to what extent by starting from the story we were going present to the investors and going backwards. To execute the plan, VUT started to support us, and we worked together from June 2024 to May 2025.

Chida: We recognized that it was vital to build solid traction for Things’ next fundraising. I recall that we needed to achieve results in three months or so, considering the cash position.

Having discussed with Suzuki-san, we decided to take action mainly based on the following two points.

One was to improve the traction of our core PRISM business. Partner sales was something Things had been working on, and we carried out measures to put partner sales on track and build traction in addition to supporting direct sales.

The other was the sales activities targeting large corporations from a different angle than PRISM. We proposed a new product leveraging GenAI to win PoCs.

Suzuki-san had previously assumed that GenAI and PRISM work well together, but he had not been able to thoroughly test it, so we decided to lend a hand.

An emerging winning strategy for partner sales

──Let me ask you about the measures for partner sales. Generally, it seems that many companies work on partner sales after fully delivering results in direct sales. Why is it that Things started so early?

Suzuki: It is largely due to the nature of the PLM. Generally, customers considering PLM implementation often spend several years to clarify requirements, and most customers we approach at exhibitions are still in early stages of consideration, gathering information.

On the other hand, system integrators and distributors hold customers’ crucial information, such as the switchover being necessary within six months, as they have been in contact with customers for a long time. We hypothesized that directly approaching them would shorten the negotiation cycle.

The speed varies among partners, with some introducing customers right away while others take longer. This disparity is something we cannot see by only looking at partner company’s websites, necessitating a trial-and-error approach through extensive collaboration. This presented a considerable challenge for a seed-stage startup with limited resources.

──In that situation, what kind of measures did you take with the VUT?

Chida: The first steps we took were establishing a clear goal and designing the strategy/tactic for discovering partners. After discussing with Suzuki-san, we set the goal of acquiring new partners and aiming for approximately 10 business meetings per month through partners.

We then identified approximately 100 partner companies that handle products similar to PRISM, such as PLM, ERP (Enterprise Resource Planning: A system that integrates and manages accounting, human resources, production, logistics, etc.), and Computer-Aided Design (CAD). We approached these companies one-by-one by sending inquiry forms.

Additionally, we leveraged GB’s network of large corporations. Together with Suzuki-san, we created opportunities to present the sales benefits of PRISM to potential large corporate partners, thereby expanding our partner network.

Suzuki: We were able to reach the target number of business interviews created within the deadline thanks to the support provided by Chida-san and other GB members.

Another achievement was reducing the negotiation period, which proved our hypothesis. Direct sales usually require a longer negotiation period, but we found that we could reduce it to roughly one-third when partners are involved. Partner companies can gain information on highly engaged customers, so collaborating with them will reduce the lead time to implementation, just as we expected.

Chida: Through our partner companies, we also had an opportunity to compete for a multi-million dollar project.

We discovered that an irregular strategy of pursuing both partner and direct sales could be somewhat effective for seed-stage startups, particularly when the product life cycle is long like PLM. This was a significant finding for us, despite our initial doubts about its viability.

Exploring and standardizing how to sell a GenAI product

──Another question is about proposing the GenAI product to large corporations. What was your hypothesis after identifying the affinity between GenAI and PLM?

Suzuki: The mainstream of digital transformation (DX) in manufacturing was the innovation through enhanced database, cloud, or drawing capabilities.

Examples include introducing CAD and CAE (Computer-Aided Engineering: Tools for performing simulations and analyses such as virtual prototyping and testing on computers). Also, DX has traditionally targeted information that can be processed quantitatively. Since the foundational information was already digitized, processing was easier, making DX relatively straightforward.

On the other hand, PLM deals with engineering knowledge and know-how. This data is managed as unstructured data such as text and diagrams, making it difficult to handle with traditional digital technologies. Additionally, Japan’s unique documentation culture has created a hurdle requiring extensive preprocessing before implementing DX.

However, GenAI excels at interpreting such unstructured data that has not been quantified. We hypothesized that combining GenAI products with existing PRISM could significantly expand the market, and we worked with VUT to verify this hypothesis.

Matsuda: We needed to explore what value and solutions GenAI products could offer as few companies were incorporating GenAI into their operations at the time.

What we first did was attend business meetings with Suzuki-san and gain an understanding of our customers’ challenges.

Large corporate customers have a diverse set of challenges and needs. These range from companies still relying on paper-based drawings and know-how, to those struggling to effectively utilize digitized data, and those lacking a clear roadmap for leveraging manufacturing data.

The level of enthusiasm for adopting GenAI products and value propositions that resonated with customers varied significantly depending on their specific challenges and needs. Therefore, we classified and organized customer challenges by level, created proposal templates tailored to the identified sales approaches, and worked with Suzuki-san to develop a growth story that not only focused on the PoC sales approach but also eventually lead to the main PLM product.

Additionally, we leveraged our GB network to introduce approximately 10 to 20 large corporations, aiming to maximize implementation opportunities.

──Have you gained any insights from your efforts to attract new customers?

Suzuki: We have found that the automotive parts industry has been particularly responsive. With major automakers such as Toyota investing heavily in AI, the entire industry seems to feel a sense of urgency to take action.

Matsuda: We also held a workshop with an automotive parts manufacturer to identify issues within their company. Listening to the voices of those on the frontlines, we felt confident that there were issues and needs that could be solved using GenAI. We worked together with Suzuki-san to design the content and helped facilitate the workshop itself.

Suzuki: We also received the highest reaction ever at an automotive industry trade show. Here, we used the technical term “automation of DRBFM (Design Review Based on Failure Mode: A method for preventing quality defects)” to attract customers, and it seems to have had a significant impact.

Chida: VUT also participated in the exhibition as Things’ booth staff and ran a PDCA cycle for the core message we wanted to convey. During the exhibition, we found that a certain number of companies responded strongly to the bold statement indicating that AI will automate and make DRBFM much easier. Some representatives were so excited that they said, “This is exactly what we wanted to do! I will bring our company’s executive vice president here right now!”

Suzuki: These efforts have led to specific achievements, and we have been able to start the PoC with Fujitsu (Japanese only). We have been able to acquire customers that could not have been reached with the PLM alone.

Changes that Things saw after bouncing back

──How did this initiative affect fundraising? Could you tell us about the value you saw in VUT?

Suzuki: There are two things that affected fundraising. One is simply that the increased traction has made various metrics more convincing. This directly appealed to investors.

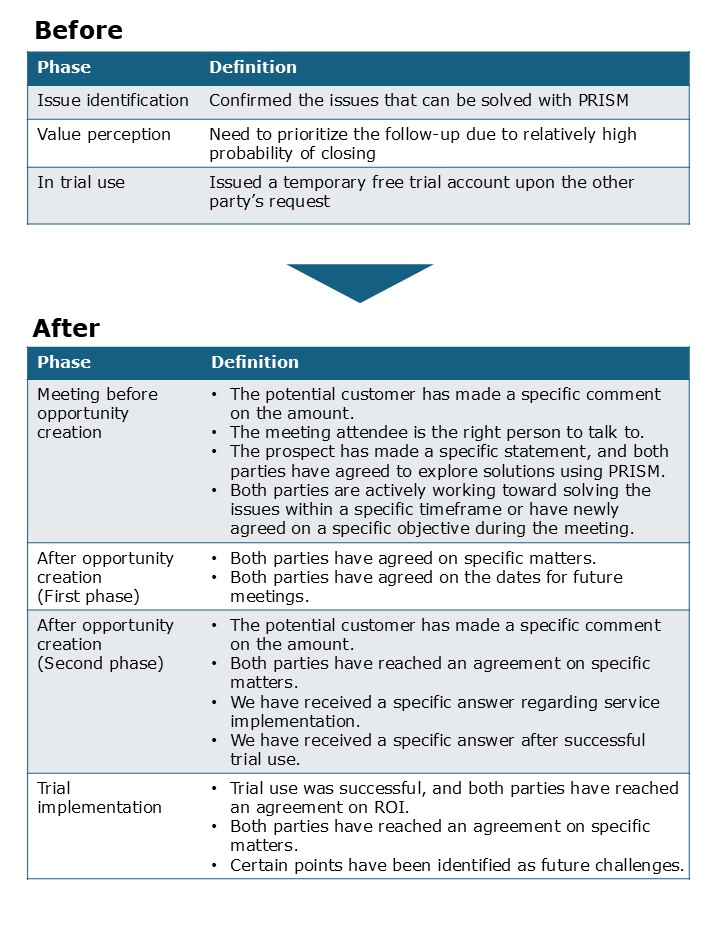

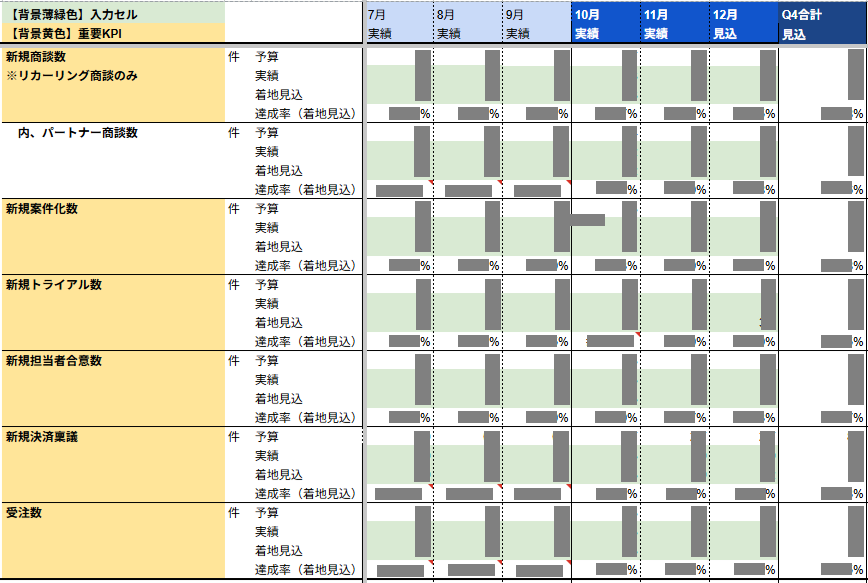

The other was standardizing and visualizing pre-sales KPIs. We also built a framework for defining sales phases and conducting more detailed sales analysis. With this framework in place, we can now see transition rates such as the probability of moving from the initial meeting to the second meeting or the probability of moving to a trial implementation. This allows us to offer investors quantitative explanations, such as the expected order volume in six months based on the current deal count.

Since we deal with PLM that takes time to implement, it is a huge improvement that we were able to highlight our company’s future potential not only through current sales but also through other perspectives, such as the progress of sales negotiations, which are intermediate indicators, and qualitative changes in negotiations. Thanks to this, we were able to successfully complete our funding.

The value I see in VUT is its strong execution capabilities. In cases like this, where finding PMF is crucial, the number of trial-and-error attempts is important. The culture of grit has been embedded in our company.

While value-up support often remains at the strategic planning level, VUT takes a hands-on approach that goes far beyond expectations. They approached the project with the same energy as if they were the second founding members of our company.

Chida: Matsuda and I even wore T-shirts with the Things logo on it, and we cleaned up the exhibition booth with just the two of us (laughs). This experience demonstrated the trust and acceptance we have received from the Things members, making us feel like part of the team.

──What insights and experiences has VUT gained through this initiative?

Matsuda: Our major experience was the process of exploring together the value to be emphasized. The process of forming hypotheses without clear answers or a guaranteed path to success, discussing them with Suzuki-san, and then testing them in actual business negotiations truly felt like being a founding member launching a new business.

Chida: What stood out to me about this support was the tight deadline. In typical sales support for portfolio startups, we take a good amount of time to hypothesize and test before engaging in sales negotiations. However, with Things, we had to build traction in just about three months.

It was intense because we were not entirely sure about the success of either the GenAI product or partner sales. But working under such pressure, I truly feel our level of support and expertise grew significantly.

──Now that you have successfully navigated those challenging days and completed your fundraising, could you share Things’ vision for the future of your business?

Suzuki: We are currently fully focused on two key areas: manufacturing and GenAI.

Over the six months of support from VUT, we have made significant progress in our AI initiatives with large corporations, which has enabled us to present a compelling story that strongly resonates with our manufacturing customers. Our goal is to lead the way in this domain and build a solid record of accomplishments.

Specifically, the vast amount of unstructured data held by major manufacturing customers—such as tables and presentation slides rich in expertise—has largely been underutilized until now. We will leverage the power of GenAI to extract the insights buried within these materials, thereby enhancing and streamlining operations.

While the past decade of DX primarily focused on utilizing structured numerical data, the next decade will be the era of leveraging unstructured data. Things is now well-positioned to pioneer this immense market of transforming unstructured data in manufacturing.

We also plan to recruit new members who are eager to tackle this market, and we would be delighted to connect with anyone who is interested.

Note: The names of roles and affiliations may have changed after the interview.

(Interviewed and written by the Universe Editorial Team)