Co-Creation Happens Where Startups and Large Corporates Explore Synergy - GBAF 2024 Report

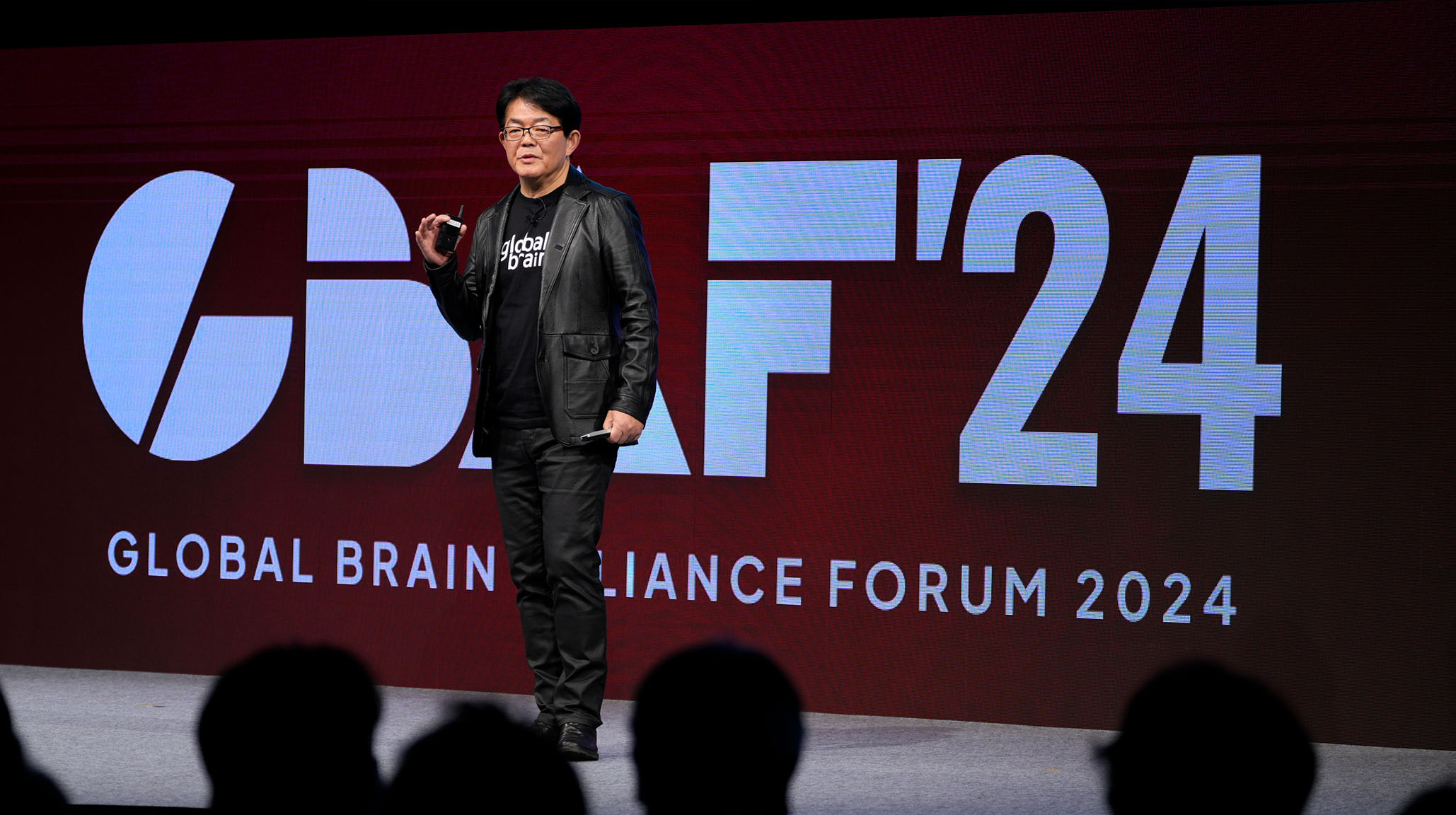

The Global Brain Alliance Forum is an annual event hosted by Global Brain Corporation. Read on to check out the digest of President & CEO Yasuhiko Yurimoto’s keynote session and what was discussed in sessions with guest speakers.

Written by the Universe Editorial Team

Global Brain (GB) held the Global Brain Alliance Forum 2024 (GBAF 2024) in December last year, an annual event where we explore the latest startup trends and boost collaboration between startups and large corporations.

The event consisted of talks by our CEO Yurimoto covering market trends, panel discussions joined by many guest speakers, the startup pitchbattle, and more.

After the final session ended, we held a networking party for startups and large corporations which was joined by many looking for new business opportunities. This article gives you a digest of the GBAF 2024.

Startup market trends and GB’s new strategies

Yurimoto kicked off the event with his keynote speech titled, “New Trends in the Global Investment Environment,” which covered detailed market trends drawing on data ranging from the amount of money invested in startups and the number of investments to valuations and fundraising amounts.

Investment remained sluggish in the US market, a trend continuing from Q4 2021. Despite some sectors such as GenAI being on a high, overall the market is not out of the woods yet, with an increasing number of startups dialing back on their hiring. On the contrary, Japan’s market does not seem to be diminishing. The number of listings has not dropped, and fundraising amounts are on the rise, indicating many positive trends compared to the US and Europe.

However, the world is still living through a winter period in startup funding. In his session, Yurimoto stressed that this funding winter presents significant opportunities for Japanese corporates and startups. When US companies stop hiring, Japanese companies have better chances of tapping into talented resources and considering M&As of foreign startups that are struggling with stagnant valuations.

During the 2008 financial crisis and at other times of recession, numerous innovative startups such as Uber, Airbnb, Raksul, and Mercari to name a few emerged, and all became leaders of the following generation. Yurimoto called out strongly to the Japanese corporates among the audience saying, “Please do not extinguish the fire of open innovation, because now is the time for you to actively pursue business collaboration with startups.”

In his afternoon session, Yurimoto revealed GB’s new strategies and reflected on the year 2024 by sharing the firm’s track record of investments, overview of the funds launched, and fund performances. To learn more about GB’s new strategies, please read this article.

Synthetic biology attracting attention in every industry

Yurimoto’s keynote session was followed by GB’s venture capitalist Atushi Ueda’s session titled “Trends and Potential in Synthetic Biology.” As a former researcher of Otsuka Pharmaceutical Co., Ltd. focused on gut microbiome, he is now responsible for investing in food, microorganism, bio, healthcare, AgriTech, and other sectors.

Ueda first explained about synthetic biology, an area of deep tech where valuable substances are produced by engineering organisms with useful functions using biotechnology. He pointed out how the engineered organisms produced using this technology could potentially be applied in various areas including pharmaceuticals, food, fuel, and highly-functional materials, with a possibility of drastically transforming existing industries.

According to Ueda, among the synthetic biology startups out there, the promising ones are companies with foundational technology (platforms) that can be used in any sector. He referred to GB’s portfolio companies bitBiome and endophyte as examples and introduced their businesses and on-going joint research projects with third parties.

The startups selected for GB’s accelerator program, now in its third year

GB has been running the accelerator program XLIMIT since 2022. At the GBAF 2024 XLIMIT Showcase, five seed-stage startups selected for the 3rd batch of XLIMIT pitched on stage.

This time we were excited to welcome the first foreign company joining the XLIMIT program. The five startups were diverse in their businesses - a SaaS company driving digital transformation of sales, a dementia screening solution, a VTuber business, and more.

Note: We will cover more details in a separate article.

GB’s two new initiatives

At the GBAF 2024, we had two sessions to introduce GB’s most recent initiatives.

GB is now the only Japanese VC/CVC to have been proudly selected as a co-investment partner in the Call-for-Partnerships (CFP) of SEEDS Capital, the Deep Tech investment arm of Enterprise Singapore. In this session, Amanda Dizon, Regional Director of Enterprise Singapore and GB’s Ying Jian Ng investing in Singapore, came on stage to announce the details of the collaboration between Enterprise Singapore and GB.

Ying Jian explained that GB’s track record of investing in Deep Tech and its capability to support commercialization were highly-recognized, which led to this appointment as a co-investment partner. He also highlighted the advantages this partnership brings to GB’s flagship funds and CVC funds where GB acts as the sole GP.

Amanda closed the session by sharing her vision, saying, “The Singapore startup ecosystem is very energetic. We are eager to use this partnership as a trigger to expand synergy with many more Japanese companies.”

The second initiative announced in the following session was GB’s ESG activities.

GB has been stepping up its ESG efforts since 2021, stipulating ESG policies and conducting ESG surveys targeting all portfolio companies in and out of Japan. In 2024, we became a signatory of the Principles for Responsible Investment (PRI), an international framework encouraging investors to take greater responsibility with their investments, and we have welcomed new members to enhance our ESG efforts.

GB’s Nagisa Shigetomi, ESG Policy Manager, said, “We will ramp up our operations to support startups in their ESG efforts in an attempt to continue taking accountability for our investments and achieve a sustainable society.”

Sakana AI talks about its technology and strategies

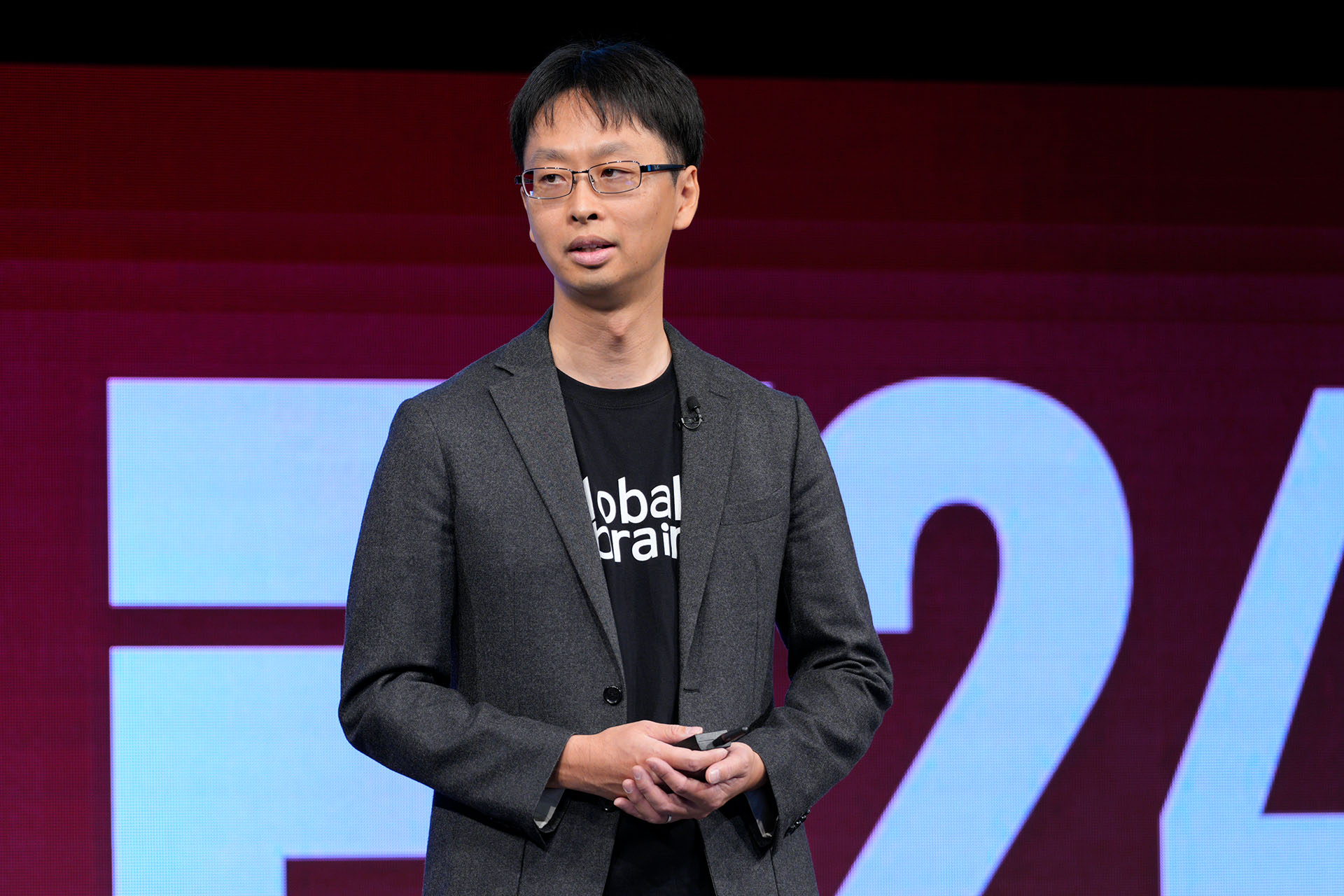

The ESG session was followed by “The Forefront of AI Innovation and Sakana AI’s Strategies.” This session consisted of two parts, with the first half welcoming COO Ren Ito of the AI startup Sakana AI to share his company’s technology and future visions.

While other AI giants focus their efforts in developing large language models everywhere we look, Ito has applied a completely different method to develop AI models. Using what this startup calls the “evolutionary model merge,” Sakana AI is developing high-quality AI models without investing huge amounts of money or data.

Furthermore, Ito stressed that Sakana AI not only has a unique way of building AI models but also has its own way of using the models. One of them is the concept of “agentic middleware,” which is about combining multiple AI models, and this technology has the potential to streamline complex operations for companies.

Lastly, Ito expressed his ambition to solve the challenges Japan faces and work with companies in various sectors to develop AI models for practical use.

Ito’s session was followed by a discussion with GB’s Shigeru Mitarai, investing in AI startups. The two talked about various topics ranging from Sakana AI’s AI agent development method and AI model research policies to how it sees the AI market.

What “truly successful CVCs” do

GB operates a number of CVC funds for many large corporations, and among them, Mitsubishi Electric and Mitsui Fudosan are the two companies that have successfully invested in startups and launched business collaboration initiatives.

We invited these two companies’ CVC team members and the CEOs of the startups they collaborated with on stage to learn about the secret behind their successes.

Note: We will cover more details in a separate article.

Eight startups pitched at the annual Pitch Battle

The Startup Pitch Battle is an event we cannot forget. We welcomed eight startups recently garnering attention to pitch on stage, all companies we have invested in over the past 12 months.

Startups from diverse sectors participated and explained their businesses and potential, including a SaaS business driving utilization of product data, an AI security service provider, an eSIM provider for tourists going overseas, and a welfare platform provider.

Note: We will cover more details in a separate article.

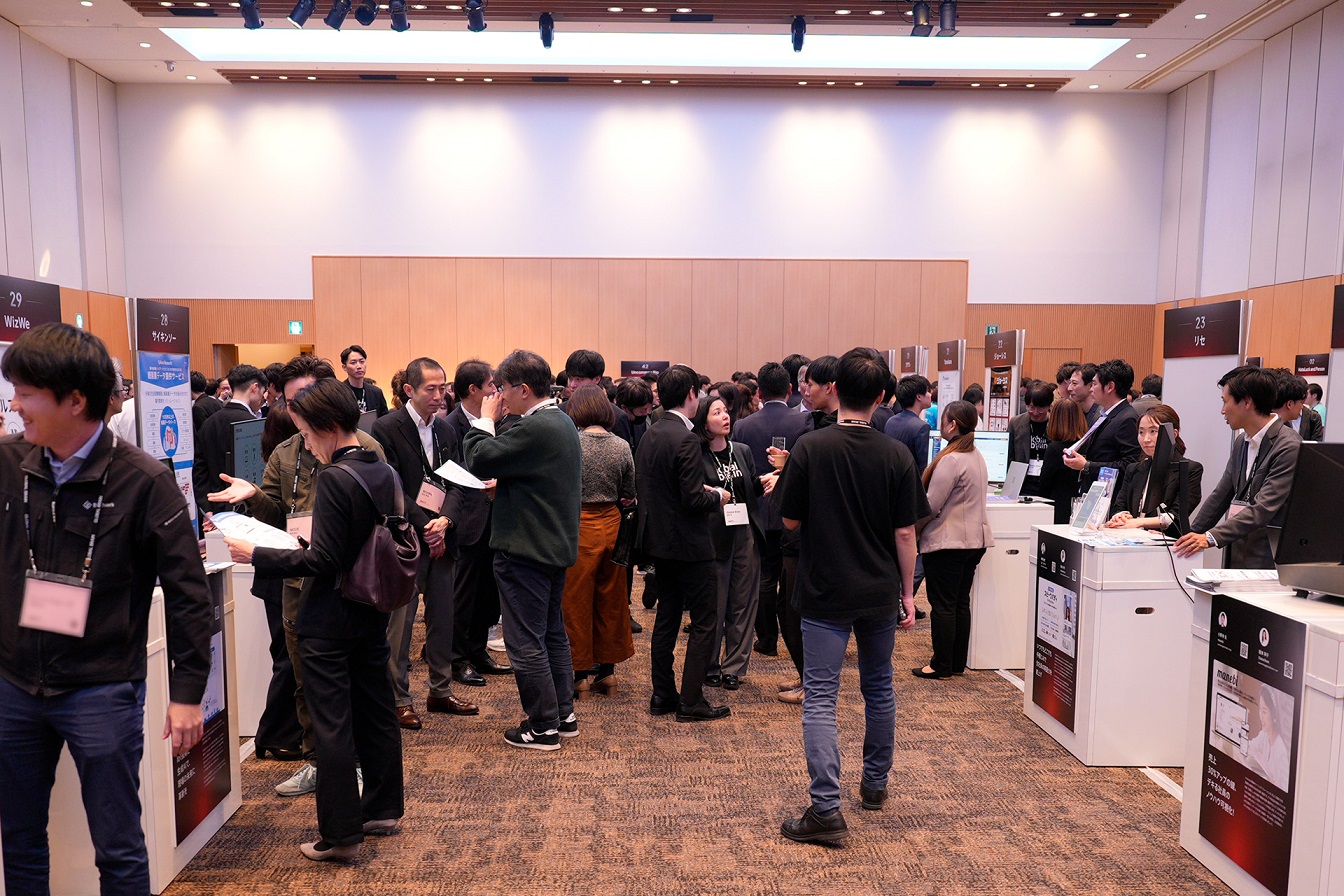

An opportunity for startups and large corporates to interact

After all the sessions were over, we held a networking party with booths set up by over 40 next-gen leading startups. In addition to XLIMIT startups and Pitch Battle presenters, a variety of companies in different sectors gathered - AI, FinTech, bio, healthcare, and more.

The members of startups, CVC funds, and large companies were engaged in conversations here and there, exploring business opportunities in a very lively atmosphere. We hope the GBAF 2024 has played a role in opening doors to as many new co-creations as possible.