A Year Since Its Launch: Latest Updates on How ANA's CVC Supports Startups

ANA is investing in and working with various startups in sectors such as mobility, space, and AI. We asked about its ongoing projects and how it works with startup founders.

Written by the Universe Editorial Team

In April 2024, ANA HOLDINGS INC. (ANA) jointly established the corporate venture capital (CVC) fund ANA Future Frontier Fund with Global Brain Corporation (GB). In only a year since its launch, the fund is investing in various startups ranging from mobility and space to AI, and is already showing positive collaboration results.

What kind of value does ANA bring to startups in diverse sectors? How has it been communicating with the founders? To learn more, we sat down with Director Yoshiaki Tsuda of ANA Future Creation Hub and New Business Development, which manages the CVC fund, and Fund Manager Kei Takamura of ANA Future Frontier Fund, New Business Development.

(The names of roles and affiliations may have changed after the interview.)

A dramatic shift from “no to CVCs”

──How did the CVC fund start?

Tsuda: ANA’s innovation initiatives kicked off in full swing around 2016, when the Digital Design Lab (DD-Lab) was launched.

The DD-Lab was a platform for accepting business ideas from employees and turning them into businesses after internal screening and PoCs. Rather than collaborating with outside partners such as startups, it was focused more on internal zero-to-one development.

Because of this and other reasons, although we were investing in venture capital funds as a limited partner, our stance was “an absolute no to CVCs.” We even spoke on stage representing large companies that are not doing CVCs at one of GB’s events for large corporations (laughs).

Then, the coronavirus pandemic marked a major turning point. The pandemic caused grave impact on aviation businesses, and we were faced with a pressing need to turn non-aviation departments into profit centers, at a greater scale than before.

To create an unprecedented scale of innovation, internal zero-to-one development was not enough. In the medium-term management strategy formulated while the company was carrying a large amount of debt during the pandemic, a budget was secured to plant the seeds for new business development, and a decision to launch a CVC fund was made as part of the initiative.

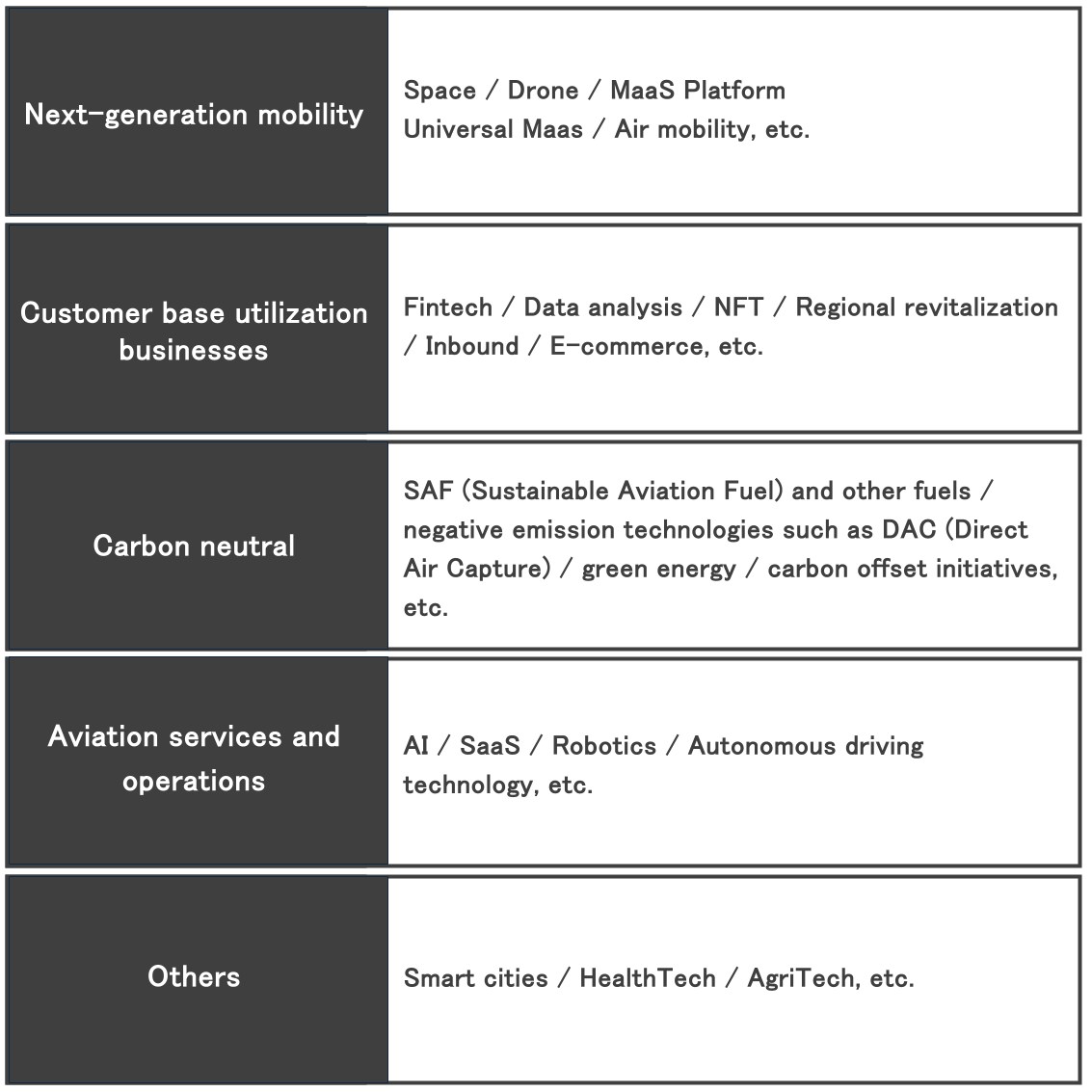

──Your fund focuses on five investment fields including next-generation mobility and customer base utilization businesses. Why did you choose these fields?

Tsuda: These fields all have affinity with the company’s business. We focused on sectors that could contribute to expanding the revenue of our airline business and diversifying ANA’s business domains.

Especially next-generation mobility has been our focus since the DD-Lab times. Products such as flying cars and drones have synergy with airline businesses. Mobility can be broadly interpreted to include MaaS (Mobility as a Service: a service that integrates public transit and other transportation options, allowing users to search, book, and pay through a single platform) and the AI customer service robot that can move around on its own launched by a company which ANA established. Since mobility has a wide coverage, it can diversify our business domains.

Also, customer base and mileage services are among our strong assets. The ANA Mileage Club holds over 40 million members, and their annual credit card spending is among the highest in Japan. Services that we prepared during the pandemic such as the online shopping mall ANA Mall (the website is in Japanese only) and ANA Pay (the website is in Japanese only) have been launched, strengthening the foundation to leverage customer assets even more. We are considering collaborating with FinTech and data analytics startups that can leverage such assets.

Mobility, space and AI –kicking off business collaborations

──Can you share some ongoing projects with startups you invested in?

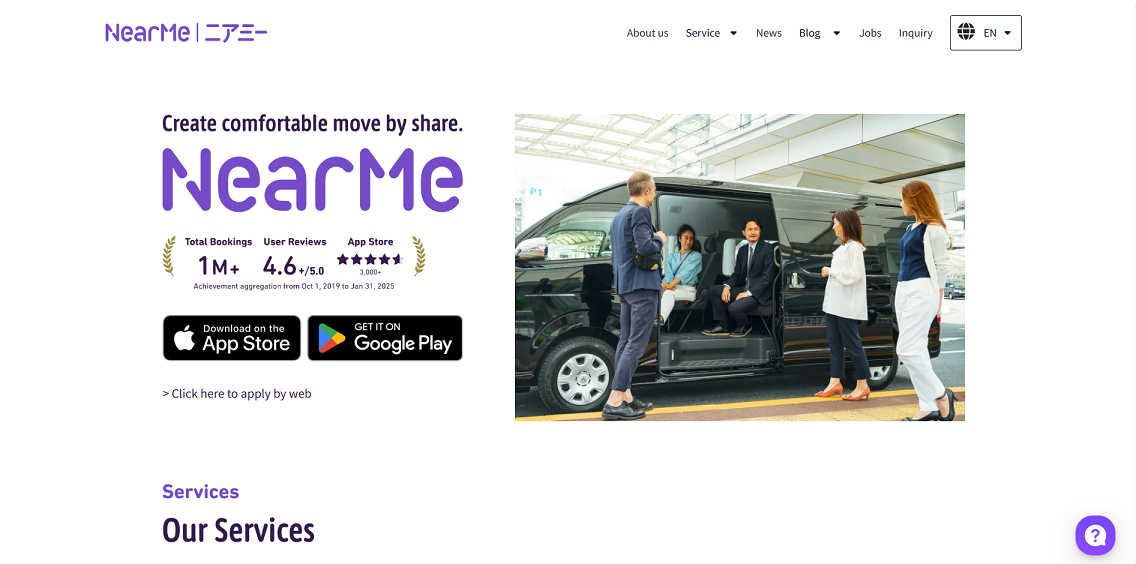

Takamura: We have two projects running with NearMe, a startup that offers an economically and environmentally-friendly ride sharing service by leveraging its proprietary AI to plan optimized routes.

One is collaboration with Travel CUBE, ANA’s MaaS service. Travel CUBE is a platform which allows customers taking flights to search routes and make bookings for trains, buses, and taxis. We had been linking our mileage service with NearMe, but with this investment, we are now discussing the possibilities of further deepening collaboration with NearMe’s services. By connecting its services with Travel CUBE, we can offer value by contributing to expanding the user base of NearMe and offering more options to ANA’s customers for traveling to airports plus enabling them to earn miles.

Another ongoing discussion is on the transport system for ANA Group’s employees. We are looking at a wide range of possibilities, and using NearMe’s services is on the table. NearMe can expect an improvement in the accuracy of its systems, since us implementing its services will lead to usage expansion, while ANA Group can improve convenience for employees’ commute and optimize the cost incurred for employee transport.

Similar to what we are doing with NearMe, we are also considering using the products of eSIM service provider trifa for our employees.

When we posted the press release announcing our investment in trifa, a member of our Digital Transformation Department told us they wanted to try out trifa’s eSIM when dispatching staff to a local airport to prepare for a new international route. This has turned into a larger project, and we are considering providing trifa’s eSIM to other employees who need cellular data connection on overseas business trips.

If trifa becomes an option our employees can use for internet connection on overseas business trips, ANA can look forward to cost reduction and trifa can increase sales, so this would be a win-win collaboration.

We also have several initiatives with startups in the space sector. A group company of ANA has started working with Axelspace which develops microsatellites.

Another partnership we have is with New Zealand-headquartered Zenno Astronautics. ANA Trading will carry out sales and marketing activities of its superconducting magnetic torquers for high-precision satellite positioning in the Japanese market. ANA Trading has already showcased this startup’s superconducting magnetic torquer at an exhibition in Japan, and it has received media coverage. Discussions with a Japanese satellite business is underway for implementation of the superconducting magnetic torquer.

Although Zenno is an overseas startup, we had very close discussions on how to proceed with this partnership. We went to New Zealand together with ANA Trading’s employees to discuss what kind of collaboration is possible, and as a result, Zenno and ANA Trading were able to sign a Memorandum of Understanding for expansion into the Japanese market and successfully exhibit its product in Japan in a very short time.

──We have also invested in BlueWX, a spinoff from a joint research of ANA and Keio University, which offers AI-based turbulence and wind forecasting.

Tsuda: BlueWX is built on an idea of a then employee, which won the grand prize at a space business idea contest held by the Cabinet Office and the Japan Aerospace Exploration Agency (JAXA). The startup was founded after an international patent was obtained for the turbulence forecasting model jointly developed with Keio University.

Not only can this technology potentially be offered to airline companies all over the world, we believe non-aviation industries also have demand for its wind forecasting solution. We are eager to pursue these opportunities.

ANA Future Creation Hub and New Business Development works with The University of Tokyo, Kyushu University, the University of Tsukuba, and Hosei University among others in addition to Keio University. Rather than participating in the likes of industry-academia collaboration programs, we actively search and meet researchers based on what we want to do. We are thick-skinned in a way, asking eminent professors at the Department of Aeronautics and Astronautics, The University of Tokyo for lectures and advice, borrowing the lab space around Kyushu University’s campus to build experimental devices, and getting involved in the management of the University of Tsukuba’s spinoff.

Working with founders we do not mind being deceived

──What assets of ANA do you think attract these startups?

Tsuda: This is something I mentioned earlier, but our customer base is one big asset. Customers who use miles are mostly high earners, so startups that are eager to approach such customers especially find this asset attractive.

Another unique asset would be that we have many operation sites such as airports and maintenance sites. Business collaboration with AI and robotics startups engaged in streamlining, automation, and saving labor is rife with possibilities.

──Cultural gaps between large corporations and startups or the difficulty of involving business units of large corporations can sometimes hinder smooth business collaboration. Is there anything you keep in mind to ensure smooth progress?

Takamura: I am especially careful not to go after only short-term outcomes. Both with startups and our own company’s business units, I believe it is important to build long-term relationships.

The passion to achieve good results is of course important, but if you rush to do so, both the startups and our company would run out of energy. After being involved in the CVC fund for a year, I truly feel the importance of being relaxed and having a long-term perspective when working with startups.

Tsuda: Startup collaboration is not something we must do. If we force ourselves to kick off business collaboration, we could end up setting quotas for the number of startups we want to connect with or start introducing all the startups we meet to the business units, preventing us from doing what we should be focusing on. We need to carefully select the startups we truly want to work with and connect only those companies to internal stakeholders.

To do so, I am convinced that meeting with the startup founders is crucial. Within our team, we say to ourselves to not invest in a startup when we do not know the personality and character of the founder. We only invest in startups led by someone we do not care even if we are fooled.

This is why we went to New Zealand to meet the Zenno Astronautics members, and although it has not been released yet, we are considering investing into a Korean startup, and our CVC member flew there to meet the team.

──What kind of members do you have in the CVC team who communicate with the startups?

Takamura: We have three front-line members including myself. One is based in Silicon Valley, sourcing foreign startups mainly in the US, and has obtained an MBA in France using the company’s overseas study program.

The other member also has a unique background, being seconded to the New Energy and Industrial Technology Development Organization (NEDO) during the coronavirus pandemic and having experienced planning and management of startup subsidies. This member learned how to support startups at NEDO and joined the CVC team upon returning to the company.

I am the only mid-career hire in the team. I have experienced corporate planning and new business development in multiple business companies, where I was also responsible for balance sheet investing, M&A of startups, and post-investment PMI.

Tsuda: Even inside ANA, the CVC team is a group of members with unique backgrounds. I think this uniqueness is what a person needs to have in order to engage in the risky endeavors of investing in startups and creating new businesses.

The spirit of “Hardship Now, Yet Hope for the Future”

──Tell us your visions for the CVC fund and what kind of startups you want to collaborate with.

Takamura: We will continue to invest in startups related to technologies and services in the five investment fields we are focusing on. However, throughout the past year since we launched the CVC fund, we have learned more about internal situations and the market environment, and are starting to see some adjustments we should make in these focus fields. Based on our learnings, we will continue to invest actively.

I personally want to meet startups that relate to ANA’s corporate vision, “Uniting the World in Wonder.” I would love to work with founders who are positive, forward-looking, and eager to try new things. Especially founders who are focused not only on short-term profits but those who are passionate to change society in the long-term.

Tsuda: My hope is for the three front-line members to do whatever they are truly determined to do with the startups. If they come across startups they feel are truly interesting, I believe the business units will naturally follow suit and proceed with business collaboration. In my eyes, ANA is a company that is relatively open to trying new things.

This is because we were originally a startup company flying helicopters. There are documents that express apologies from the founder to the then employees regarding late payment of salaries. Every few years, we share these startup-like episodes at all-employee training sessions. “Hardship Now, Yet Hope for the Future” are the words of ANA’s founder which hangs on the wall of the meeting room used for management meetings. This spirit may have been what helped us overcome past crises such as the coronavirus pandemic and the 2008 financial crisis.

Although the pandemic continued to pose severe challenges, many employees stayed with the company. Now that ANA has overcome this crisis, we are in the stage of hoping for the future. With this spirit, we are excited to continue our journey with startups eager to shape the future.